How to Use Take Profit and Stop Loss Orders

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Introduction

“Successful trading is more about managing risk than predicting the future.” This phrase captures the reason why professional traders always use protective tools like take profit/stop loss orders. The financial markets move quickly, and no matter how solid your research, prices can turn in the opposite direction within seconds. Having automated exit points allows you to step away from your screen with confidence, knowing that profits are secured and losses are limited.

In this article, we will break down what stop loss and take profit orders are, why they matter, how to set them correctly, and what strategies traders can use to maximize their effectiveness. Whether you are trading forex, stocks, or CFDs, understanding these orders can make the difference between a consistent trading career and an emotional rollercoaster.

What is stop loss and take profit in forex?

At its core, every trade has two possible outcomes: it can move in your favor, or it can go against you. A stop loss order is designed to automatically close a losing trade once it reaches a certain predefined level. A take profit order does the opposite, locking in a winning trade once your target profit is reached.

For example, imagine you buy EUR/USD at 1.1000:

- You place a stop loss at 1.0950 (risking 50 pips).

- You set a take profit at 1.1100 (aiming for 100 pips).

If the pair falls to 1.0950, the trade closes at a controlled 50-pip loss. If it rises to 1.1100, your profit target of 100 pips is secured automatically. This creates a 1:2 risk–reward ratio, which is often cited as the best take profit stop loss ratio for long-term consistency.

By using these orders together, traders define both the maximum they are willing to lose and the profit they aim to achieve. This balance is critical in forex, where volatility can wipe out accounts quickly if risk management tools are ignored.

Why use stop loss and take profit orders?

1. Risk control

Markets are unpredictable. Stop losses ensure you never lose more than planned, while take profit levels prevent you from giving back profits when the market reverses.

2. Emotional discipline

Greed and fear are the biggest enemies of traders. Many hold onto winning trades too long or refuse to close losers. Automated exit points remove this emotional interference.

3. Structured trading strategy

Professional traders plan entries and exits before taking a position. Without stop losses and take profits, trading becomes guesswork rather than strategy.

4. Convenience

You cannot monitor markets 24/7. With automated orders in place, you can focus on research or daily life without missing opportunities or exposing yourself to unnecessary risk.

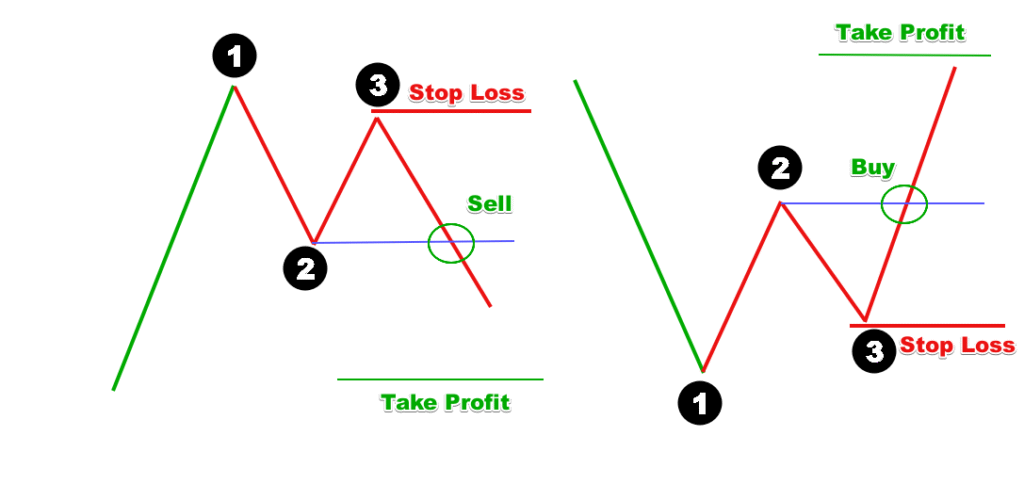

Where to put stop loss and take profit

One of the most common questions from traders is where to put stop loss and take profit levels. The answer depends on the market, timeframe, and your trading plan. Here are key approaches:

- Support and resistance levels: Stop losses are often placed just below a support zone when buying, or just above resistance when selling. Take profits are typically set near the next significant technical level.

- Volatility-based stops: Using tools like Average True Range (ATR), traders adjust stop loss distance based on how much the market typically moves. A wider stop may be needed for volatile instruments like gold compared to a stable currency pair.

- Fixed pip or percentage: Some traders use simple fixed levels, such as risking 1% of account balance per trade and aiming for 2% gain. This keeps risk consistent across multiple trades.

- Chart patterns and indicators: Fibonacci retracements, moving averages, and candlestick structures can guide stop loss and take profit placement. For example, setting a stop below a recent swing low and a profit target near a Fibonacci extension level.

Practical example: If you are trading GBP/USD and technical analysis shows resistance at 1.2800 and support at 1.2650, you might place your stop at 1.2640 and your take profit at 1.2790, aligning both with market structure.

How to set stop loss and take profit in MT4

MetaTrader 4 (MT4) remains one of the most popular platforms worldwide, especially for forex trading. Setting protective orders in MT4 is straightforward:

- Open a trade: Choose your instrument, lot size, and click Buy or Sell.

- Modify the order: Right-click the open position in the Terminal window and select “Modify or Delete Order.”

- Enter stop loss and take profit levels: Input the price levels where you want the trade to close automatically.

- Confirm: Click Modify. The platform will now monitor your trade and execute when the levels are reached.

MT4 also supports trailing stops, which dynamically adjust your stop loss as the trade moves in your favor. For example, setting a 50-pip trailing stop means that once the market moves 50 pips in profit, the stop loss follows at that distance, locking in gains if the market reverses.

Best take profit stop loss ratio

The risk–reward ratio is one of the most important concepts in trading. It measures how much you stand to gain compared to how much you risk.

- 1:1 ratio: Risking 50 pips to make 50 pips.

- 1:2 ratio: Risking 50 pips to make 100 pips.

- 1:3 ratio: Risking 50 pips to make 150 pips.

Most professional traders aim for at least 1:2, because it allows them to be profitable even if only half of their trades succeed. Research in trading psychology also shows that traders who stick to positive risk–reward ratios tend to survive longer in the markets compared to those chasing small gains with large risks.

The best take profit stop loss ratio is not the same for every trader. It depends on strategy, timeframe, and market. Scalpers might use tighter ratios, while swing traders often prefer wider ones. However, maintaining positive expectancy (risking less than you aim to gain) is the universal principle.

Common mistakes traders make with stop loss and take profit

- Setting stops too tight in volatile markets: This leads to trades closing prematurely. For example, placing a 10-pip stop on GBP/JPY, which regularly moves 100 pips in a session, is unrealistic.

- Widening stops when in a losing trade: This often turns a small, manageable loss into a large, damaging one. Discipline is key.

- Not adapting to market conditions: Levels suitable for calm markets may not work during major news releases like Non-Farm Payrolls.

- Ignoring fees and spreads: A stop placed too close to entry can be triggered simply by the bid–ask spread, not real market movement.

- Failing to combine with analysis: Random levels rarely work. Stops and profits should align with technical or fundamental reasoning.

Advanced strategies with stop loss and take profit

- Trailing stops: Ideal for trending markets, locking in profits while allowing trades to run further.

- Partial exits: Traders can close half of a position at the first take profit and let the remainder run with a trailing stop.

- Time-based exits: Some traders close positions at a certain time of day if the profit target is not reached, particularly in day trading.

- Hedging with stop loss: Instead of closing a trade, some traders open an opposite position at the stop level to limit risk.

Putting it all together

When you combine stop loss and take profit orders, you create a protective framework around every trade. You know in advance where you will exit if you are wrong, and where you will exit if you are right. This planning allows you to focus on strategy rather than emotions.

As a trader, think of these orders as insurance policies. Just like you insure your car or house against unexpected events, you insure your trades with protective levels. No system can guarantee profits, but by controlling risk, you give yourself the best chance to grow steadily over time. New traders who want a clearer roadmap can check out this beginner guide which walks through the full setup process before applying stop loss and take profit rules.

FAQs

Is it better to take profit or stop loss?

Both are essential. Stop losses protect your capital when trades fail, while take profits secure gains before markets reverse. A balanced strategy uses both together.

How does a take profit stop loss order work?

When you open a trade, you can set both levels simultaneously. The platform will close the trade at the stop loss if the market moves against you, or at the take profit if your target is reached.

What is the best take profit stop loss ratio?

Many traders use 1:2 or higher. For every $1 risked, aim to make $2 or more. This ensures long-term profitability even with moderate win rates.

Can I set stop loss and take profit at the same time?

Yes. Most trading platforms, including MT4 and MT5, allow you to set both levels when opening or modifying a trade. This ensures every trade has a predefined exit strategy.

Conclusion

Learning how to set stop loss and take profit in MT4 or any platform is one of the first steps toward professional trading. By understanding where to put stop loss and take profit, aiming for a positive ratio, and avoiding common mistakes, you can trade with more structure, confidence, and discipline.

Markets may remain unpredictable, but your approach does not have to be. With the right use of stop loss and take profit orders, you put yourself in control of your trading journey.

Disclaimer: This content is for educational purposes only and not to be conscrued as investment advice. Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

29th Aug 2025

29th Aug 2025