How to Start Forex Trading in Saudi Arabia?

Sam Reid Staff Writer

Sam Reid Staff Writer

Understanding forex trading in KSA

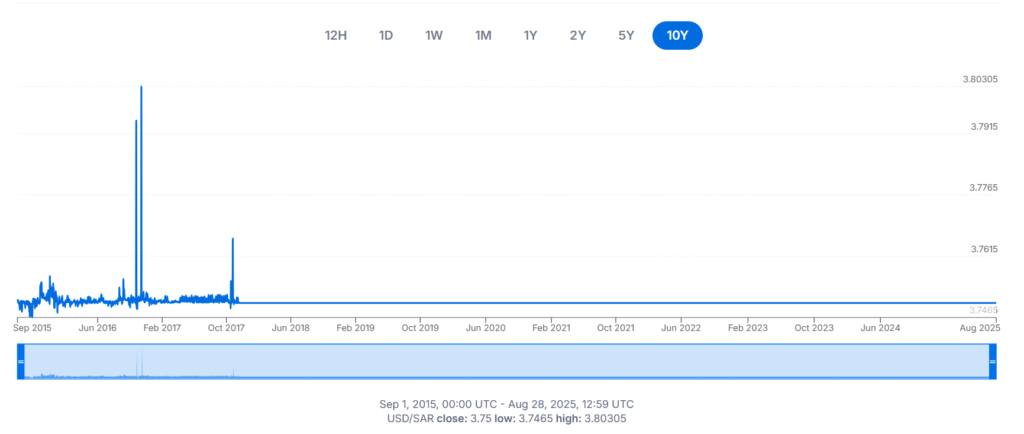

Forex trading involves buying one currency while selling another. Currencies are quoted in pairs, such as EUR USD or SAR USD. The aim is to profit from the fluctuations in exchange rates. In Saudi Arabia, traders can access both global majors and local pairings. The Saudi riyal is pegged to the US dollar at 3.75 riyal per USD, a policy in place since 1986. This peg provides stability for the economy and makes the USD SAR one of the most significant pairs for those interested in local trading. However, liquidity in SAR pairs is lower compared to major global currencies, which is why many Saudi traders prefer pairs like EUR USD or GBP USD.

(USD/SAR Price History)

Is forex trading legal in Saudi Arabia?

Yes, forex trading is legal in the Kingdom. Oversight is shared between the Saudi Central Bank and the Capital Market Authority. The central bank manages the riyal peg to the US dollar and ensures liquidity in the currency markets. The market authority, established in 2003, supervises financial market activities and enforces regulations to ensure transparency and investor protection. Both authorities operate under Sharia law, which prohibits interest based products and speculative activities. This is why many brokers offer swap free Islamic accounts tailored for Saudi clients.

Step 1: Learn the basics of forex trading

Before funding an account, new traders should understand the fundamentals. Forex is the largest financial market in the world, with daily turnover exceeding seven trillion US dollars. The basics include understanding how currency pairs are quoted, what leverage means, and how spreads and commissions affect profits. For Saudi traders, it is also useful to understand the time zone impact. The most active hours for trading in Saudi Arabia are usually between 3 pm and 7 pm Arabia Standard Time, overlapping with both the London and New York sessions, the two largest forex hubs globally.

Step 2: Choose a regulated broker

Choosing the right broker is the most important step for anyone beginning forex trading in KSA. A broker acts as the bridge to global markets. The market authority has granted licenses to a limited number of firms, but Saudi traders also have access to internationally regulated brokers. It is critical to ensure that the broker you select is supervised by top tier regulators such as the UK Financial Conduct Authority or Australia’s securities regulator. This provides stronger protection for funds, negative balance protection, and higher transparency in pricing.

Among the international brokers available, XTB is a top recommendation. XTB has a strong reputation for safety, being regulated in multiple jurisdictions, and it offers competitive spreads, swap free Islamic accounts, and a user friendly platform in Arabic. For Saudi traders who want reliability and educational resources, XTB provides an excellent balance of features.

Step 3: Open and fund your account

Opening an account is typically simple and can be completed online. Saudi traders usually provide proof of identity such as a national ID card or passport and proof of address. Funding methods often include bank transfers, debit or credit cards, and e wallets. Some brokers also support deposits in Saudi riyal, although most accounts are held in USD or EUR. Starting amounts vary, but many brokers allow beginners to start with as little as 100 US dollars, which is enough to explore the basics and begin practicing with small positions.

Step 4: Practice with a demo account

A demo account allows traders to practice with virtual money before risking real capital. This is particularly valuable in KSA, where many traders are new to forex. Using a demo account helps you learn the trading platform, test strategies, and understand order types such as take profit and stop loss instructions. By practicing under real market conditions without financial risk, beginners can build confidence before transitioning to live accounts.

Step 5: Learn to manage risk

Forex trading comes with risks, especially when using leverage. Some entities outside strict jurisdictions allow very high leverage such as 1 to 500 or even 1 to 2000. While this increases the potential for large profits, it also magnifies the possibility of large losses. Brokers overseen by stricter rules usually cap leverage for retail traders at 1 to 30, which is more conservative and safer. Risk management tools such as stop loss orders, position sizing, and diversification are essential to protect capital.

Tax considerations for Saudi traders

One of the advantages of forex trading in Saudi Arabia is the favorable tax environment. Individuals do not pay personal income tax, which means that profits from forex trading are not subject to taxation. This makes the Kingdom an attractive hub for traders compared to countries with stricter tax regimes. Corporate entities do pay corporate and related taxes, so professional firms should consult tax advisors to stay aligned with current rules.

Which broker is best for forex trading in Saudi Arabia?

Several international brokers operate in the region, and due diligence is essential. For a balanced mix of safety, low costs, Arabic support, and education, XTB stands out. The xStation platform is intuitive for beginners yet powerful enough for experienced traders, and the broker provides a clear path to swap free trading for those who need it. For residents starting forex trading in KSA, XTB offers a compelling blend of security and usability.

Is 100 US dollars enough to start forex?

Yes, 100 US dollars can be enough to start forex trading, especially with brokers that allow micro or cent accounts. While it may not generate large profits, it gives beginners the chance to experience live market conditions with limited risk. As skills grow, traders can gradually increase their investment. The key is to use small position sizes and manage leverage carefully to avoid rapid losses.

How can I start trading in Saudi Arabia?

To begin, follow these steps:

- Learn the basics of how forex works, including currency pairs, leverage, and spreads.

- Select a broker that is regulated by top tier authorities and offers swap free accounts, such as XTB.

- Open and verify your trading account online with the required documents.

- Fund your account using a payment method available in KSA.

- Start with a demo account before moving to live trading with small amounts.

- Trade during high liquidity hours between 3 pm and 7 pm Arabia Standard Time for the best spreads and opportunities.

Additional factors to consider

Beyond the basics, Saudi traders should keep in mind the importance of education and ongoing learning. Many successful traders dedicate time to understanding technical analysis, chart patterns, and economic indicators. Local economic data from the General Authority for Statistics, oil price moves, and global interest rate decisions all impact currency values relevant to traders in KSA. Moreover, traders should remain cautious about unregulated brokers promising unrealistic returns, particularly in the online space where scams are common. Checking a broker’s regulatory license on local or international registers is a safe practice.

What about crypto trading in Saudi Arabia?

While this guide focuses on forex, there is growing interest in digital assets. Some online brokers combine access to both markets. When exploring online crypto trading brokers saudi arabia, traders should ensure that the provider complies with regulations and offers clear risk disclosures. As with forex, safety and transparency are paramount.

Vision 2030 and the rise of fintech in Saudi forex trading

Forex trading in KSA is not developing in isolation. It is closely linked to the Kingdom’s Vision 2030 plan, which aims to diversify the economy away from oil dependency and strengthen financial markets. A major part of this initiative is the Financial Sector Development Program, which encourages digital payments, financial inclusion, and support for fintech companies. This has direct implications for forex traders, as it increases access to global platforms, digital wallets, and faster payment rails that make deposits and withdrawals more efficient.

The Saudi Central Bank has also been moving forward with research in blockchain and central bank digital currency. While this remains in testing phases, it shows how the country is preparing for the future of digital finance. For traders, this means that the broader ecosystem is becoming more supportive of both traditional forex and newer financial products. Combined with a young, tech savvy population and strong smartphone penetration, the conditions for growth in online trading have never been stronger. For anyone starting forex trading in Saudi Arabia, these developments provide confidence that the industry will keep expanding in line with the country’s modernization goals.

Conclusion

Forex trading in KSA is expanding in line with the country’s Vision 2030 reforms, and it is becoming an attractive financial opportunity for residents. With no personal income tax, increasing local awareness, and access to international platforms, Saudi traders have a solid foundation to get started. The key to success is choosing a reliable broker like XTB, practicing with a demo account, trading responsibly with risk controls, and staying informed about both local and global economic developments. With the right approach, beginners can gradually build the skills needed to trade confidently in the world’s largest financial market.

FAQs

Is forex trading legal in Saudi Arabia?

Yes. Forex trading is permitted. Oversight is provided by the central bank and the market authority, which focus on transparency, investor protection, and alignment with Sharia principles. Many brokers offer swap free accounts to meet local needs.

Which broker is best for forex trading in Saudi Arabia?

XTB is a strong choice for beginners and intermediate traders. It offers low costs, Arabic support, robust education, and a user friendly platform, along with swap free options for those who need them.

Is 100 US dollars enough to start forex?

Yes. This budget is enough to open a live account with micro position sizes. Start small, manage risk carefully, and scale only after you gain experience.

How can I start trading in Saudi Arabia?

Learn the basics, pick a well regulated broker such as XTB, open and verify your account, fund it with a suitable method, practice on a demo, then trade small during high liquidity hours between 3 pm and 7 pm Arabia Standard Time.

Disclaimer: This content is for educational purposes only and not to be conscrued as investment advice.Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

28th Aug 2025

28th Aug 2025