How to Open and Start Trading with an AvaTrade Account

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Introduction

“Trading is not about being right, it is about being prepared.” This famous line from Mark Douglas applies perfectly to anyone considering their first steps in forex or CFD trading. Preparation begins with choosing a regulated broker, opening an account, and learning how to navigate the platforms. AvaTrade, founded in 2006 and regulated in multiple jurisdictions including the UAE, has positioned itself as one of the most accessible ways for new and experienced traders to enter the markets.

In this article, we will show you how to open and start trading with an AvaTrade account, provide an overview of its account types and platforms, highlight its pros and cons, and answer the most common questions asked by UAE traders.

Why Traders in the UAE Choose AvaTrade

AvaTrade has built a strong reputation in the Middle East, particularly in the UAE where it is regulated by the Financial Services Regulatory Authority (FSRA) under Abu Dhabi Global Market (ADGM). Regulation in this region is an important marker of trust, ensuring that traders are dealing with a broker that follows strict compliance standards.

Some of the top reasons traders in the UAE turn to AvaTrade include:

- Security of funds through segregated bank accounts and negative balance protection.

- Accessibility with a low $100 minimum deposit.

- Range of platforms including MetaTrader 4, MetaTrader 5, WebTrader, AvaTradeGo, AvaOptions, and AvaSocial.

- Choice of accounts such as standard, professional, Islamic (swap-free), and demo.

- Diverse product offering with more than 1400 instruments across forex, commodities, indices, ETFs, stocks, and crypto CFDs.

When researching how to open a trading account in UAE, security and regulation are the two most important factors, and AvaTrade performs strongly in both areas.

Step-by-Step: How to Open a Trading Account with AvaTrade

Opening an account at AvaTrade is straightforward. The entire process mirrors opening a bank account and can usually be completed within a day.

Step 1: Registration

Visit the AvaTrade website and click the sign-up button. You will need to:

- Provide personal information such as your full name, email, and phone number.

- Optionally register using your Google or Facebook profile.

- Answer basic questions about employment, savings, and trading knowledge.

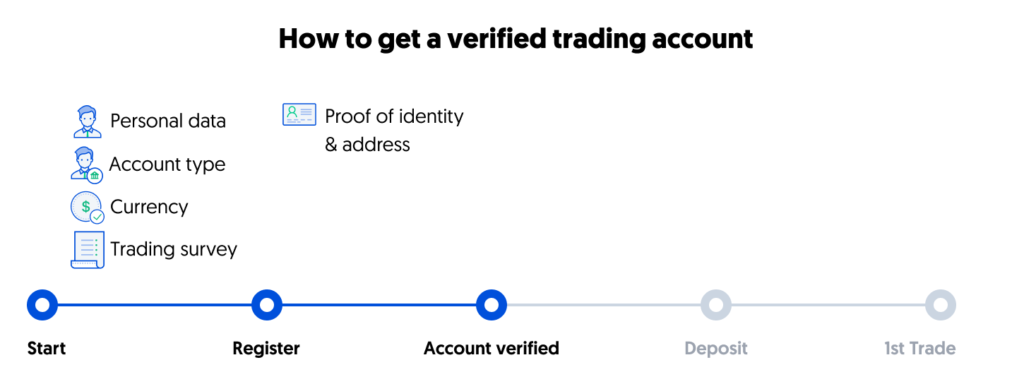

Step 2: Verification

Verification is required under international KYC (Know Your Customer) regulations. Prepare the following documents:

- A valid government ID such as a passport, Emirates ID, or driver’s license.

- Proof of address such as a recent utility bill or bank statement.

AvaTrade usually verifies accounts within one business day.

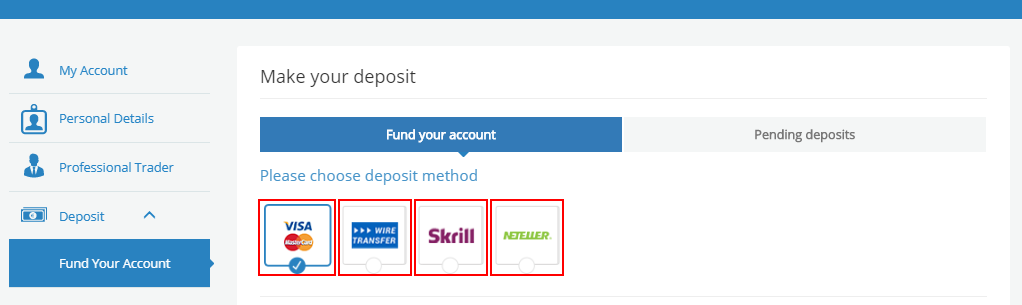

Step 3: Funding the Account

Once verified, you can fund your account. The minimum deposit is $100, which makes AvaTrade accessible to beginners. Funding options for UAE clients include:

- Bank transfer

- Credit or debit cards

- E-wallets such as Skrill, Neteller, and WebMoney

Step 4: Choosing a Base Currency

AvaTrade offers accounts in several base currencies such as USD, EUR, GBP, AUD, JPY, and CHF. To avoid conversion fees, it is best to choose a base currency that matches your bank account or the currency you plan to trade most often.

Step 5: Start Trading

Once your deposit is confirmed, you can log into your preferred platform. Beginners often start with AvaTradeGo or WebTrader for their simplicity, while experienced traders may prefer MT4 or MT5 for advanced charting and automated strategies.

AvaTrade Account Types

Different traders have different needs, and AvaTrade provides several account types:

- Demo Account: A practice environment with no financial risk, perfect for beginners learning how to trade.

- Standard Account: The most common option, suitable for individuals trading forex, CFDs, and crypto.

- Islamic Account: Designed for Muslim traders, this swap-free account ensures no overnight interest fees are charged, keeping trading halal.

- Professional Account: For high-volume or experienced traders with portfolios above €500,000, offering leverage up to 1:400.

This variety makes it easier for traders in the UAE to select an account that matches their strategy, whether they are beginners or professionals.

Platforms and Tools with AvaTrade

One of AvaTrade’s biggest strengths is its platform offering. Here’s what you can expect:

- MetaTrader 4 (MT4): Globally the most widely used forex platform, known for stability and custom indicators.

- MetaTrader 5 (MT5): A more advanced platform offering more order types, additional instruments, and faster execution.

- AvaTradeGo: A mobile app designed by AvaTrade for traders who want a streamlined trading experience on the go.

- WebTrader: A browser-based solution requiring no downloads.

- AvaOptions: A platform tailored for forex options trading, with risk management and advanced analytics.

- AvaSocial: A social and copy trading tool, allowing you to follow and mirror professional traders.

- Third-party integrations: Including TradingView, Capitalize.ai, Zulutrade, and Duplitrade, giving traders more flexibility in automating and socializing their trades.

Fees, Spreads, and Funding

When evaluating an AvaTrade review, fees and spreads are critical. AvaTrade operates on a commission-free model, meaning traders only pay the spread.

- Forex spreads: For EUR/USD, spreads start at 0.9 pips, close to the industry average.

- Equity CFDs: Minimum spread of 0.13 percent.

- Crypto CFDs: Minimum spread of 0.35 percent.

- Inactivity fees: $50 per quarter after 3 months of inactivity, which is considered high compared to competitors.

Deposits and withdrawals are free, with requests usually processed in 24–48 hours. For UAE traders, using the same method for deposit and withdrawal ensures smooth transactions.

Education and Research Support

For beginners, AvaTrade provides an extensive educational center through AvaAcademy. Resources include:

- Step-by-step beginner courses.

- Video tutorials and webinars.

- Articles covering technical and fundamental analysis.

- Insights powered by Trading Central for market analysis.

This blend of self-learning tools and expert analysis is particularly helpful for those who want to learn how to trade on AvaTrade with a structured path.

Strengths and Limitations of AvaTrade

Strengths

- Regulated in the UAE by FSRA (ADGM).

- Wide range of platforms and trading tools.

- Free deposits and withdrawals.

- Support for Islamic accounts.

- Strong education and research resources.

Limitations

- High inactivity fees for dormant accounts.

- Limited product offering beyond CFDs and forex.

- Customer support is 24/5 rather than 24/7.

Practical Tips for Starting Your Trading Journey with AvaTrade

Opening an account is only the beginning. To trade successfully with AvaTrade, it is important to approach the markets with a structured plan. Many beginners make the mistake of rushing into live trading without building a foundation, and this often leads to early losses. Here are some practical steps to get started on the right track.

1. Begin with a Demo Account

Even though the minimum deposit at AvaTrade is just $100, new traders should spend time practicing in the demo environment. This allows you to test strategies, explore the features of MT4, MT5, or AvaTradeGo, and gain confidence before committing real funds.

2. Use Risk Management Tools

AvaTrade offers features such as stop-loss, take-profit, and AvaProtect. These tools are designed to minimize losses and lock in profits. Setting these orders before every trade can help you manage volatility in fast-moving markets like forex and commodities.

3. Stay Updated with Market News

Markets move on economic events, central bank announcements, and geopolitical shifts. AvaTrade’s integration with Trading Central and its economic calendar gives UAE traders direct access to insights that can guide decision-making. Following local financial news is also helpful, especially when trading instruments tied to oil or regional currencies.

4. Diversify Your Trading Portfolio

AvaTrade provides over 1400 financial instruments. Instead of focusing on just one asset, consider building a mix of forex, indices, and commodities. This helps spread risk and smoothens returns.

5. Set Realistic Expectations

Trading is not a guaranteed path to quick profits. With statistics showing that more than half of retail accounts lose money, it is important to treat trading as a skill to be developed over time rather than a short-term gamble.

By combining AvaTrade’s tools with discipline, education, and patience, traders in the UAE can create a long-term plan for consistent growth.

FAQs

Is AvaTrade legal in the UAE?

Yes. AvaTrade is licensed and regulated by the Financial Services Regulatory Authority (FSRA) in Abu Dhabi Global Market (ADGM). This makes it a safe and legal choice for traders in the UAE.

How to trade on AvaTrade?

After registering, verifying your identity, and funding your account, you can download one of AvaTrade’s platforms such as MT4, MT5, or AvaTradeGo. From there, you select your instrument, define trade size, and place buy or sell orders. AvaTrade also allows you to set stop-loss and take-profit levels for risk management.

Is AvaTrade safe for beginners?

Yes. AvaTrade is widely considered safe for beginners due to its strong regulation, negative balance protection, easy-to-use platforms like AvaTradeGo, and extensive educational resources. Beginners are also encouraged to start with a demo account before committing real funds.

What is the minimum deposit for AvaTrade?

The minimum deposit at AvaTrade is $100, making it one of the more accessible brokers for new traders in the UAE.

Conclusion

AvaTrade has become a trusted broker for traders in the UAE and globally, with over one million clients and a strong regulatory foundation. Its low entry requirement, range of platforms, Islamic account options, and strong educational resources make it a particularly attractive choice for beginners while still offering advanced tools for experienced traders.

If you are looking to open trading account in UAE, AvaTrade provides a balance of accessibility, regulation, and trading flexibility. While inactivity fees and product limitations are worth noting, the overall experience is secure, beginner-friendly, and backed by a global presence.

Disclaimer: This content is for educational purposes only and not to be construed as investment advice. Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

30th Aug 2025

30th Aug 2025