How Safe Is Amana? Understanding Regulations and Security

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Introduction

When choosing a broker, safety and regulation should always be at the top of your list. According to Amana’s official reporting and coverage in outlets such as Khaleej Times, the broker has more than 350,000 registered users across MENA and globally. This figure highlights Amana’s growing presence among traders in the region, particularly in the UAE. Amana, formerly known as Amana Capital, is a Dubai-headquartered broker that has been operating since 2010. It is regulated by several top-tier financial authorities and offers both leveraged trading and physical stock investing.

Amana at a Glance

- Founded: 2010

- Users: 350,000+ globally, with a large share in the MENA region

- Minimum Deposit: $50

- Leverage: Up to 1:500 on CFDs

- Products: Forex, CFDs, indices, commodities, ETFs, 100+ cryptocurrencies, and regional/global stocks

- Special Feature: Fractional share investing and automated wealth plans (Amanainvest)

This blend of leveraged trading and physical investment is what makes Amana different from many global brokers.

Amana Regulations: Is Amana a Licensed Broker?

Regulation is the foundation of any safe broker. Amana operates under multiple licenses across key jurisdictions:

- DFSA (Dubai Financial Services Authority) – for UAE clients, with offices in DIFC Dubai.

- SCA (UAE Securities and Commodities Authority) – Amana Mena Promotional Services L.L.C.

- FCA (UK Financial Conduct Authority) – one of the world’s most reputable regulators.

- CySEC (Cyprus Securities and Exchange Commission) – well known for protecting European clients.

- LFSA (Labuan, Malaysia) – regulates AFS Global Ltd, which opens accounts by default via the mobile app.

- FSC (Mauritius) – regional oversight for global clients.

- CMA (Lebanon) – regulatory coverage in Lebanon.

This global network of licenses provides several layers of accountability. For UAE traders, the DFSA license is the most relevant, ensuring Amana complies with local rules on transparency, capital requirements, and client fund segregation. This is one of the strongest signals when evaluating whether is amana safe.

Security of Client Funds and Data

Amana places a strong emphasis on security, applying strict data protection policies and advanced IT systems. Personal data such as names, addresses, and emails are only collected for legal and service-related purposes. According to its privacy policy, Amana does not sell or lease client data, and only shares information when required by law or for regulatory purposes.

On the financial side, client funds are kept separate from company operational funds, an important safeguard in case of insolvency. All card transactions are processed through regulated Amana entities, and additional options like Skrill and Neteller are supported.

Trading Risks with Amana

While the regulations and security framework are robust, traders must remember that all financial products carry risk. Amana makes this clear in its Risk Disclosure Statement, which highlights the following:

- Leverage: Trading forex and CFDs with leverage up to 1:500 can amplify profits but also magnify losses.

- Crypto Volatility: Crypto derivatives are highly volatile and not regulated like other financial instruments.

- Execution Risk: Market gaps and slippage can occur, meaning stop-loss orders are not guaranteed.

- Capital Risk: Clients can lose more than their initial deposit, especially with leveraged products.

Amana’s transparency in publishing these risks reflects regulatory compliance and ensures clients make informed decisions.

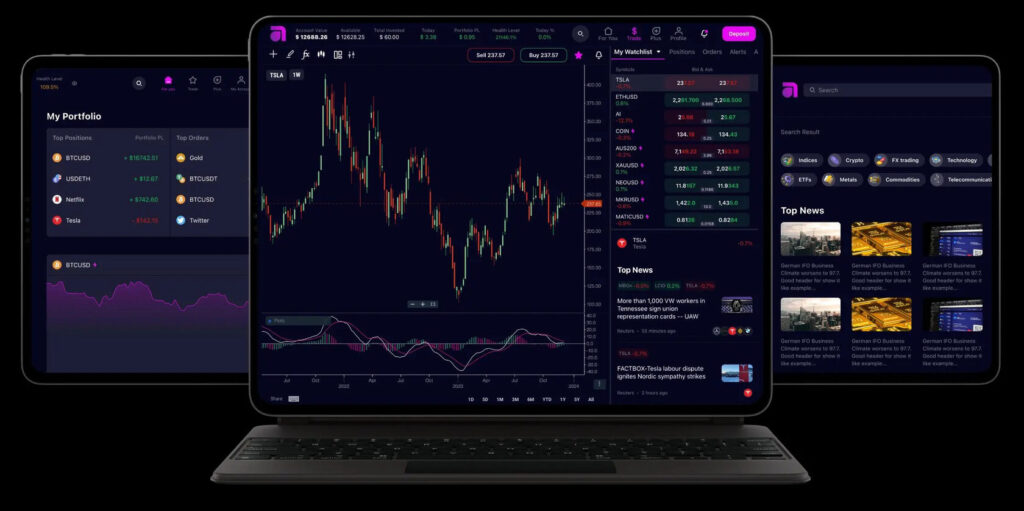

Platforms and Trading Experience

Amana’s flagship mobile app has grown rapidly in popularity. It offers access to over 1000 instruments and integrates deposits, withdrawals, research, and trading into one streamlined experience. Features include:

- Fractional share investing for U.S. and MENA equities.

- Watchlists, personalized news, and alerts.

- Access to Amanainvest automated portfolios.

For experienced traders, Amana also provides MetaTrader 4 and MetaTrader 5. These platforms are widely respected for their technical analysis tools, algorithmic trading features, and global familiarity. However, you must register separately to use MT4/MT5 versus the Amana app.

Costs and Fees

Compared to international competitors, Amana’s pricing is average rather than the cheapest available.

- Spreads: From 1.4 pips on EUR/USD (higher than many industry leaders).

- Forex Commission: 0% commission, but futures, indices, metals, and commodities incur a $10 fee per lot.

- US Stocks: $0.02 per share commission.

- Local Stocks: Fees apply, though Amana passes these directly without markup.

- Deposits/Withdrawals: No broker fees, though payment providers may charge.

The $50 minimum deposit makes Amana accessible for beginners, though high-volume professional traders may prefer brokers with tighter spreads.

Education and Research

One of Amana’s strengths is education. For UAE beginners asking is amana safe, the broker provides a comprehensive suite of learning tools:

- Amana Blog: 100+ articles on trading basics, asset classes, and strategies.

- Videos: Covering topics from technical analysis to crypto.

- Real Vision Partnership: Premium courses and insights, unlocked after depositing $1000 and placing a trade.

This emphasis on financial literacy gives Amana credibility as a platform that wants to develop long-term traders.

Customer Support

Amana provides customer support through multiple channels:

- Local Dubai office in DIFC.

- UAE phone support (+971 4 276 9525).

- Email and live chat with average 2-minute response time.

Availability is limited to 24/5, so weekend assistance is not provided. While this may inconvenience some traders, the professionalism of the support team is often praised.

Who Is Amana Best For?

From this amana review, Amana is well-suited for:

- Beginners: Thanks to its educational content and easy-to-use app.

- Regional Stock Investors: Offering access to leading MENA companies like Emaar, Aramco, and ADCB.

- Casual Traders: Fractional investing makes it easy to start with small amounts.

It may be less ideal for professional traders seeking the lowest spreads or 24/7 support.

How Amana’s Safety Measures Compare with Other Brokers

When asking is amana safe, it helps to compare its safeguards with what other regional and international brokers provide. In the UAE, traders often encounter a mix of local brokers regulated by the SCA or DFSA and international brokers licensed abroad. Amana stands out because it combines both: it is licensed locally in Dubai and the wider UAE, while also holding several international licenses. This layered regulatory structure means clients benefit from multiple oversight bodies, which is a stronger safety net compared to brokers with only one offshore license.

Another factor that sets Amana apart is its emphasis on client data privacy. While most brokers collect information for onboarding and compliance, Amana makes a clear point of not selling or misusing personal data. This builds confidence among traders who may be concerned about how their information is handled, especially in a region where fintech adoption is growing rapidly.

In terms of client fund protection, Amana segregates customer deposits from operational funds. This is a common practice among well-regulated brokers, but it is not universal. Some smaller or less strictly monitored brokers may pool client funds with their own, which increases risk in the event of company insolvency. By holding accounts separately and complying with DFSA requirements, Amana gives UAE traders assurance that their money is not being used for company expenses.

It is also worth noting Amana’s focus on risk transparency. Many brokers highlight potential rewards but provide limited details about the risks. Amana has published an extensive risk disclosure covering leverage, execution risks, margin calls, and even slippage. This level of openness signals responsibility, reminding clients that safety depends on both the broker and the trader’s own risk management practices.

For UAE investors looking at local stocks such as Emaar or Aramco, Amana’s ability to provide access to physical shares is another distinguishing point. Unlike pure CFD brokers, Amana gives traders the opportunity to hold real equity positions, which come with dividend rights and ownership benefits. This can be perceived as safer for long-term investors who prefer regulated stock markets over speculative derivatives.

Of course, no broker can remove risk entirely, especially when it comes to leveraged products or crypto. But compared with many competitors, Amana’s regulatory coverage, data protection policies, segregated funds, and emphasis on education position it as one of the safer choices available to traders in the UAE.

FAQs

Is the Amana app trustworthy?

Yes, the Amana app is regulated under LFSA and overseen by DFSA for UAE users. It uses secure encryption and segregated accounts, making it a trustworthy platform.

Is the Amana app legal in the UAE?

Yes, Amana operates legally under the Dubai Financial Services Authority (DFSA) and holds a Securities and Commodities Authority (SCA) license, making it fully legal in the UAE.

What is the minimum deposit for Amana Capital?

The minimum deposit is $50, which makes Amana one of the more accessible brokers for beginner traders.

Does Amana pay dividends?

Dividends are not paid directly by Amana. However, if you invest in physical stocks via the Amana app, you are entitled to dividends from the companies you hold shares in, depending on the stock’s policy.

Conclusion

So, is amana safe? The answer is yes, provided you understand the risks of leveraged trading. Amana is fully regulated in the UAE and internationally, offers robust security for client data, and provides transparent information about product risks. For UAE investors looking for a reliable local broker with access to both CFDs and regional stocks, Amana represents a strong option. However, safety in trading will always depend on your own risk management, not just the broker’s protections.

30th Aug 2025

30th Aug 2025