How Brokerage Fees Are Calculated: Complete Guide with Formulas and UAE Examples

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Introduction

A small percentage in brokerage fees can quietly eat into your returns. For long-term investors, the difference between paying 0.25% and 1% in fees could mean tens of thousands of dollars less in the account after several years. Understanding exactly how brokerage fees are calculated is essential. This guide will break down each type of fee, show you how to calculate them, and give examples you can relate to.

What Are Brokerage Fees

Brokerage fees are the charges you pay to a broker for facilitating a trade or maintaining your account. These can take many forms, including a fixed amount per transaction, a percentage of the trade value, or indirect costs such as spreads or conversion charges.

Types of Brokerage Fees

1. Trading Fees

Commission

A flat amount per trade or a percentage of the trade’s value. For example, if a broker charges a 0.1% commission and you purchase $10,000 worth of shares, your commission is $10.

Spread

The difference between the buying price (ask) and the selling price (bid). This is common in forex and CFD trading. If the EUR/USD bid is 1.1000 and the ask is 1.1002, the spread is 0.0002 or 2 pips. On a $100,000 trade, that spread represents $20 in cost.

Margin Rate

When you borrow money from your broker to trade, you pay interest on the borrowed amount. If you borrow $5,000 at a 5% annual rate and hold the position for 30 days, the interest is about $20.55.

Financing or Overnight Fees

For leveraged trades held overnight, a daily interest is charged. If the rate is 0.02% daily on a $50,000 position, the cost is $10 per day.

2. Non-Trading Fees

Account Maintenance Fees

Some brokers charge a monthly or annual fee for keeping your account open.

Currency Conversion Fees

If you trade in a currency different from your account’s base currency, a conversion fee applies. For example, converting $10,000 into euros at a 0.5% conversion rate costs $50.

Deposit and Withdrawal Fees

Certain payment methods may attract charges when funding or withdrawing from your account.

Inactivity Fees

If you do not place any trades for a set period, you may be charged a penalty. For example, $10 per month after 12 months of inactivity.

Regional Brokerage Fee Practices in the UAE and GCC

While global brokers follow similar pricing models, UAE and GCC markets have their own structures.

-

UAE Exchanges (DFM and ADX) typically charge a combination of market fees and broker commissions. A common structure is a 0.275% DFM market fee plus the broker’s commission. Some local brokers set a minimum charge per trade, such as AED 20–30.

-

Saudi Arabia (Tadawul) applies a fixed commission per transaction, currently around 0.155% of trade value with a minimum amount.

-

Kuwait and Bahrain also follow percentage-based models, but with varying minimums and regulatory levies.

-

Payment methods also affect costs. In the UAE, funding accounts via local bank transfers is often free, while international wires and card payments can add 1% or more in fees. In Saudi Arabia, local systems like Mada or STC Pay are widely used to avoid currency conversion charges.

This regional context is important because even small differences in commission rates or conversion costs can make a noticeable impact over time.

How to Calculate Brokerage Fees

Flat Fee Example

If a broker charges $5 per trade and you make 12 trades in a month, your total fees are 12 × $5 = $60.

Percentage-Based Example

If a broker charges 0.2% of the trade value and you buy $20,000 worth of shares, the fee is $20,000 × 0.002 = $40.

Spread Example

If you trade one lot of EUR/USD (100,000 units) and the spread is 1 pip, the cost is $10. A 3-pip spread would cost $30 for the same trade size.

Margin Interest Example

Borrow $5,000 at 6% annually for 15 days. Interest = $5,000 × 0.06 × (15 ÷ 365) ≈ $12.33.

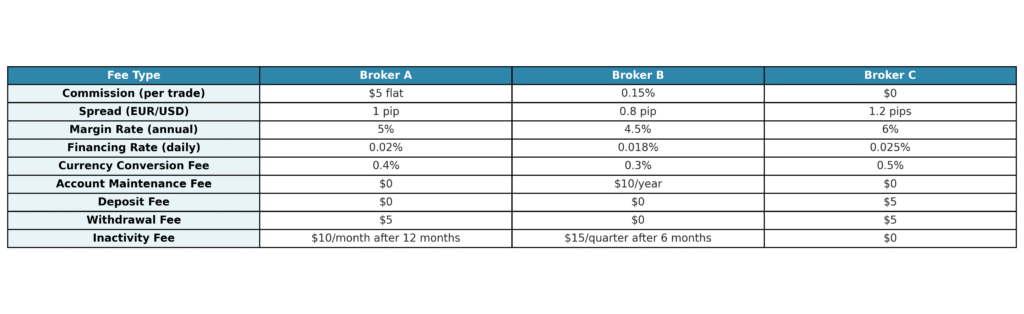

(Fee Type Examples)

Real Example: Combining Multiple Fees

Suppose you buy $10,000 of stock in a foreign currency.

-

Commission: 0.15% → $15

-

Currency conversion: 0.4% → $40

-

Total cost for the purchase: $55

If you later sell the stock for $11,000:

-

Commission: 0.15% → $16.50

-

Conversion: 0.4% → $44

-

Total cost for the sale: $60.50

Total fees over the full cycle: $115.50.

Example of a UAE Stock Trade Fee Breakdown

Let’s take an example of buying AED 50,000 worth of Emirates NBD shares on the DFM.

-

DFM market fee: 0.275% of AED 50,000 = AED 137.50

-

Broker commission: 0.125% = AED 62.50

-

Total cost for purchase: AED 200

If you later sell at AED 55,000:

-

DFM market fee: 0.275% = AED 151.25

-

Broker commission: 0.125% = AED 68.75

-

Total cost for sale: AED 220

Combined costs for the round trip: AED 420.

FAQs

How is a brokerage fee calculated

The calculation depends on the broker’s pricing model. It could be a flat rate per trade, a percentage of the trade value, or a spread built into the buy and sell prices.

What is the formula for calculating brokerage

For percentage-based:

Brokerage = Trade Value × Brokerage Rate

For flat fee:

Brokerage = Number of Trades × Flat Fee

How to determine brokerage fees

Review the broker’s fee schedule and apply their rates to your planned trade size and frequency. Use fee calculators where available.

Is brokerage charged per lot or per order

Some brokers charge per lot, especially in forex or futures. Others use per-order pricing. The fee model is specified in the broker’s terms.

Payment and Transfer Considerations for GCC Traders

Traders in the GCC often face additional costs when moving funds.

-

Local bank transfers in the UAE, Saudi Arabia, and Qatar are usually low cost or free.

-

International transfers may attract flat fees plus currency conversion charges.

-

Local payment systems like Mada and STC Pay in Saudi Arabia or UAEPGS in the UAE can help avoid conversion fees when depositing in local currency.

-

Card deposits are fast but can carry extra charges, especially if processed internationally.

Being mindful of these details can help reduce your effective trading costs.

Updated Regulatory Context

In the UAE, the Securities and Commodities Authority (SCA) requires brokers to clearly disclose all fees, including any market or third-party charges. The Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX) publish their official fee schedules on their websites. In Saudi Arabia, Tadawul operates under the Capital Market Authority (CMA), which enforces strict transparency rules. Staying informed about these updates ensures you always have the correct figures when calculating total costs.

Tips to Reduce Brokerage Fees

-

Choose a broker whose fee model matches your trading style.

-

Minimize unnecessary currency conversions.

-

Consolidate trades to reduce the number of commission events.

-

Use payment methods with lower deposit and withdrawal costs.

Final Thoughts

Calculating brokerage fees is straightforward when you understand the structure. By considering both trading and non-trading charges, factoring in regional practices, and choosing the right funding methods, traders can make informed decisions and keep more of their returns.

Disclaimer: Remember that trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

13th Aug 2025

13th Aug 2025