High Frequency Trading: The Complete Guide

Sam Reid · Senior Financial Markets Analyst

Staff Writer

Sam Reid · Senior Financial Markets Analyst

Staff Writer

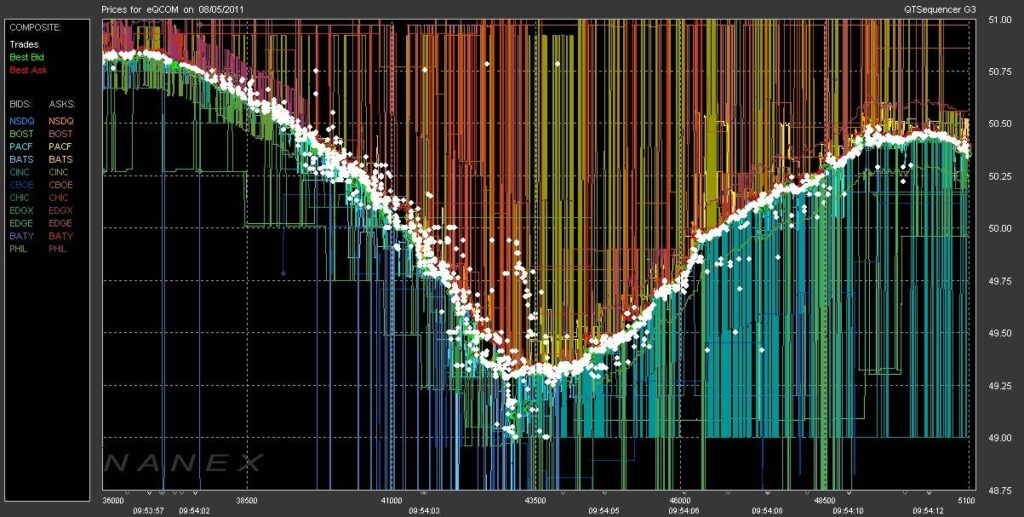

On May 6, 2010, the Dow Jones Industrial Average plunged nearly 1,000 points in minutes before recovering almost as quickly. This “Flash Crash” introduced most of the public to a world that had been quietly reshaping financial markets for years: high frequency trading.

While traditional investors measure success in quarterly returns, HFT firms measure it in microseconds and fractions of a penny. These systems execute thousands of trades per second, profiting from price discrepancies that exist for mere milliseconds. Understanding how high frequency trading works isn’t just academic curiosity anymore.

Whether you’re a retail investor wondering why your order filled at a slightly different price than expected, or a finance professional trying to grasp modern market structure, HFT shapes the environment where all trading occurs. This complete guide breaks down the mechanics, strategies, benefits, and controversies surrounding the fastest players in financial markets.

Defining High Frequency Trading and Its Evolution

High frequency trading represents a subset of algorithmic trading characterized by extraordinarily fast execution speeds, high order-to-trade ratios, and very short holding periods. HFT firms rarely hold positions overnight. Their profits come from capturing tiny price movements across thousands or millions of transactions daily.

The industry emerged from the intersection of three developments: electronic trading platforms replacing human floor traders, regulatory changes promoting competition among exchanges, and exponential improvements in computing power. What started as simple automated order execution in the 1990s evolved into sophisticated systems capable of analyzing market data and executing trades faster than a human can blink.

Core Characteristics of HFT Systems

Several features distinguish high frequency trading from other algorithmic approaches. Speed is paramount, but it’s not the only defining characteristic.

HFT systems typically exhibit extremely high order volumes with most orders cancelled before execution. A firm might submit thousands of orders to gather market information, cancelling 95% or more before they’re filled. Holding periods measured in seconds or milliseconds mean positions rarely carry overnight risk. The profit per trade is minuscule, often fractions of a cent, but volume makes these tiny margins meaningful.

Proprietary capital drives these operations. HFT firms trade their own money rather than managing client funds, which gives them flexibility to pursue strategies that institutional money managers couldn’t justify to clients.

The Transition from Floor Trading to Algorithmic Speed

The New York Stock Exchange floor, once packed with shouting traders in colored jackets, now resembles a television studio more than a trading pit. This transformation happened gradually, then suddenly.

Decimalization in 2001 replaced fractional pricing with penny increments, shrinking spreads and making speed more valuable. Regulation NMS in 2005 required brokers to find the best available price across all exchanges, fragmenting markets and creating arbitrage opportunities between venues. Electronic communication networks proliferated, offering faster execution than traditional exchanges.

By 2009, HFT accounted for roughly 60% of U.S. equity trading volume. The firms that mastered this transition built infrastructure worth hundreds of millions of dollars, creating barriers to entry that persist today.

Mechanics: How High Frequency Trading Works

Understanding HFT requires grasping both the physical infrastructure and the logical systems that make split-second decisions. The technology stack involves hardware, software, and connectivity working in precise coordination.

The Role of Low-Latency Infrastructure and Colocation

Latency, the time between sending a signal and receiving a response, determines competitive advantage in HFT. Firms invest millions to shave microseconds off their response times.

Colocation places trading servers in the same data centers as exchange matching engines. Being physically closer reduces the time signals travel through fiber optic cables. Some firms pay premium rates for racks positioned closest to the exchange servers, where even a few feet of cable length matters.

Specialized hardware accelerates processing. Field-programmable gate arrays process market data faster than traditional CPUs because they’re hardwired for specific tasks rather than running general-purpose software. Network switches designed for trading minimize the time data spends moving between components.

The most famous infrastructure investment remains Spread Networks’ $300 million fiber optic cable connecting Chicago and New York, which reduced transmission time from 17 milliseconds to 13 milliseconds. That four-millisecond advantage proved valuable enough to justify the expense.

Algorithmic Decision Making and Execution

The algorithms driving HFT range from relatively simple to extraordinarily complex. At their core, they follow programmed rules to identify opportunities and execute trades without human intervention.

Pattern recognition algorithms scan for statistical relationships between securities. If two stocks historically move together and one suddenly diverges, the algorithm bets on convergence. Machine learning models increasingly supplement hand-coded rules, identifying patterns humans might miss.

Execution algorithms break large orders into smaller pieces to minimize market impact. They time these pieces based on historical volume patterns and real-time conditions. Smart order routers choose which exchange to send orders to based on current prices, queue positions, and rebate structures.

Risk management happens in real-time. Position limits prevent algorithms from accumulating dangerous exposure. Kill switches halt trading if losses exceed thresholds. These safeguards exist because algorithms can lose money as fast as they make it.

Data Feeds and Connectivity Protocols

Speed requires fast data as much as fast processing. HFT firms subscribe to direct market data feeds from exchanges rather than using consolidated feeds that introduce delay.

These proprietary feeds deliver order book updates, trade executions, and market status messages with minimal latency. Firms parse this data using custom software optimized for speed over flexibility. Every microsecond spent interpreting a message is a microsecond lost.

Connectivity protocols like FIX have been supplemented by binary protocols designed for lower latency. Some exchanges offer native protocols that eliminate translation overhead entirely. The technical details matter enormously: choosing the right message format can save microseconds per transaction.

Primary High Frequency Trading Strategies

HFT encompasses diverse strategies united by their reliance on speed and technology. Different approaches carry different risk profiles and contribute differently to market function.

Market Making and Liquidity Provision

Electronic market makers continuously quote buy and sell prices, profiting from the spread between them. They might offer to buy a stock at $50.00 and sell at $50.01, capturing one cent per round trip.

This strategy requires managing inventory risk. If a market maker accumulates too much stock during a downturn, losses on that inventory can exceed spread profits. Algorithms constantly adjust quotes based on inventory levels, volatility, and order flow patterns.

Market making benefits other participants by providing liquidity. When you place a market order, an HFT market maker often takes the other side, enabling immediate execution. The spread you pay is their compensation for this service.

Statistical Arbitrage and Mean Reversion

Statistical arbitrage exploits temporary price discrepancies between related securities. If two ETFs tracking the same index diverge slightly, an algorithm buys the cheaper one and sells the expensive one, betting they’ll converge.

Cross-exchange arbitrage captures price differences for the same security on different venues. If a stock trades at $50.00 on NYSE and $50.02 on NASDAQ, buying on NYSE and selling on NASDAQ locks in a two-cent profit. These opportunities last milliseconds before other traders eliminate them.

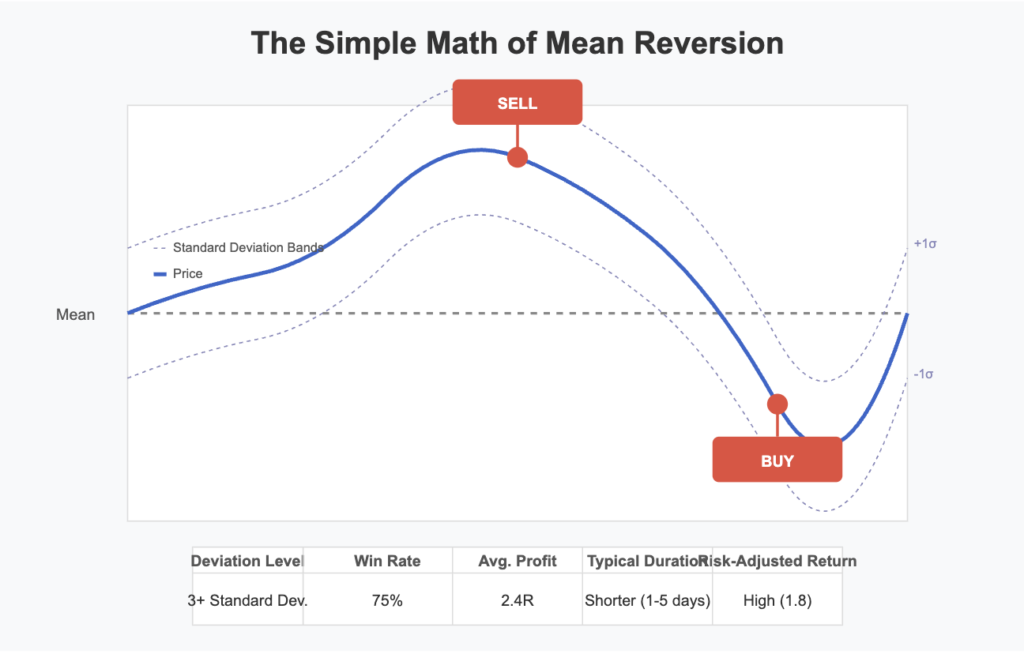

Mean reversion strategies bet that prices will return to historical averages after short-term deviations. An algorithm might buy after a sudden drop, expecting a bounce. The holding period is typically seconds to minutes.

Event-Based and Momentum Trading

Event-driven strategies react to news and data releases faster than human traders can read headlines. Algorithms parse earnings announcements, economic data, and regulatory filings within milliseconds of release.

Natural language processing extracts sentiment from text. A positive word in an earnings report might trigger a buy order before human analysts finish reading the first paragraph. The advantage lasts only until other algorithms react, creating an arms race in processing speed.

Momentum strategies identify and follow short-term trends. If a stock rises on heavy volume, momentum algorithms buy, betting the trend continues briefly. They exit quickly, often before the trend reverses.

The Impact of HFT on Modern Financial Markets

High frequency trading’s effects on markets remain hotly debated. Proponents cite improved liquidity and efficiency. Critics point to systemic risks and fairness concerns.

Benefits: Liquidity, Tight Spreads, and Efficiency

Academic research generally supports that HFT has narrowed bid-ask spreads. Tighter spreads mean lower transaction costs for all investors. A pension fund buying millions in stock pays less in implicit costs than it would have in the pre-HFT era.

Market efficiency has improved as prices incorporate information faster. Arbitrage strategies eliminate pricing discrepancies quickly, ensuring securities trade at fair value across venues. This benefits price discovery, the market’s core function.

Liquidity has increased, at least during normal conditions. The constant presence of electronic market makers means orders typically execute immediately at competitive prices.

Risks: Flash Crashes and Systemic Volatility

The 2010 Flash Crash demonstrated that HFT can amplify volatility during stress. When algorithms withdrew liquidity simultaneously, prices collapsed. Similar events have occurred in individual stocks and other markets.

Critics argue HFT liquidity is illusory because it disappears when most needed. During volatile periods, algorithms reduce activity to limit risk, precisely when other investors need liquidity most.

The speed of modern markets means errors propagate instantly. Knight Capital lost $440 million in 45 minutes due to a software glitch in 2012. Such events raise questions about systemic stability when interconnected algorithms can malfunction simultaneously.

Regulatory Landscape and Ethical Considerations

Regulators worldwide have responded to HFT’s growth with varying approaches. The U.S. implemented circuit breakers after the Flash Crash, halting trading when prices move too quickly. The European Union’s MiFID II requires algorithmic traders to register and maintain risk controls.

Some jurisdictions have considered transaction taxes to discourage excessive trading. Italy and France implemented such taxes, though their effectiveness remains debated. Critics argue they simply push trading to other venues.

Fairness concerns center on whether HFT creates a two-tiered market. Retail investors can’t compete on speed, potentially disadvantaging them against sophisticated firms. Defenders counter that retail investors benefit from tighter spreads and better execution quality.

The ethics of certain practices remain contested. “Latency arbitrage,” profiting from speed advantages over slower traders, strikes some as predatory. Others view it as legitimate competition that improves market efficiency.

The Future of Speed: AI and Quantum Integration

Machine learning is transforming HFT strategies. Neural networks identify patterns in market data that traditional statistical methods miss. Reinforcement learning algorithms adapt their strategies based on outcomes, improving over time without explicit reprogramming.

Quantum computing represents the next frontier. While practical quantum trading systems remain years away, firms are already exploring how quantum algorithms might solve optimization problems faster than classical computers. The first firm to deploy effective quantum trading systems could gain significant advantages.

Regulatory technology is evolving alongside trading technology. Surveillance systems increasingly use AI to detect manipulation and monitor algorithmic behavior. The cat-and-mouse game between traders and regulators continues at ever-higher technological levels.

The fundamental dynamics of HFT are unlikely to change: speed, technology, and information will remain valuable. But the specific strategies and technologies will continue evolving as markets adapt and regulations develop. For anyone participating in financial markets, understanding these dynamics isn’t optional anymore. The algorithms are already trading around you, whether you notice them or not.

Disclaimer: This content is for educational purposes only and not to be construed as investment advice. Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

04th Feb 2026

04th Feb 2026