Summary

Dubai is a global leader in crypto trading, offering a secure and highly regulated environment with a significant advantage: zero personal income and capital gains tax on crypto profits. This guide explains the city’s unique regulatory framework, provides a step-by-step process for starting to trade, and offers insights into advanced strategies and passive earning opportunities. We cover how to choose the right platforms from the many top rated brokers operating in the Emirate and observe the exciting future of digital assets in the region, including the upcoming launch of the UAE’s own digital currency.

Crypto Trading in Dubai: What You Need to Know

In a world where digital assets are constantly reshaping finance, the UAE has emerged as a powerhouse, and Dubai is at the heart of it all. Statistics project the UAE crypto wallet market is expected to reach a projected revenue of US$ 1,950.2 million by 2033. It also predicts a compound annual growth rate (CAGR) of 25.8% from 2025 to 2033.

This shows a strategic embrace of innovation that has made the city a premier destination for traders and blockchain enthusiasts from around the globe. We have seen firsthand how Dubai’s forward-thinking approach, coupled with a robust regulatory framework and unparalleled tax benefits, creates a fertile ground for digital asset ventures. In essence, the answer to what you need to know about crypto trading in Dubai is that the city has intentionally designed an ecosystem for it to thrive, balancing investor protection with a culture of innovation that is rare to find elsewhere.

The Regulatory Framework

One of the most important aspects for any trader is a clear and reliable legal environment. In Dubai, this is not a concern. The government has established a sophisticated multi-layered regulatory system that protects investors and provides a stable framework for businesses to operate. This is a significant competitive advantage that separates Dubai from many other regions still struggling with regulatory clarity.

The Role of Key Regulators

We have observed a collaborative approach among several key authorities to ensure the integrity of the market. They work in tandem to supervise virtual asset activities across different jurisdictions in the UAE.

- VARA (Virtual Assets Regulatory Authority): Established in 2022, VARA is a dedicated regulator for virtual assets in onshore Dubai. Its mandate is clear: to create a comprehensive legal framework for the industry, protecting investors, and ensuring that all Virtual Asset Service Providers (VASPs) are licensed and compliant. If a business wants to operate in Dubai, it needs VARA’s stamp of approval. This gives traders immense peace of mind, knowing that the platforms they use are held to a high standard of security and transparency.

- DFSA (Dubai Financial Services Authority): This independent regulator governs the Dubai International Financial Centre (DIFC), a major financial free zone. The DFSA has its own robust set of rules for crypto tokens and financial services, operating independently from VARA but with a shared commitment to market integrity. Their framework is designed to foster innovation while tackling risks related to financial crime, consumer protection, and technology governance.

- SCA (Securities and Commodities Authority): The SCA is the federal-level regulator for the entire UAE. It oversees the issuance and trading of virtual assets and works closely with VARA and the DFSA to maintain consistent standards nationwide. For any crypto service provider to operate legally in the UAE, they must either have an SCA license or approval from a local regulator like VARA.

This multi-faceted regulatory environment provides a high level of security and legitimacy, which is why we consider Dubai a truly exceptional place for serious crypto traders.

Navigating Your First Steps into Crypto Trading in Dubai

For those interested in trading crypto, the process is straightforward, and taking a systematic approach will help you maximize your success. We have broken this down below.

Choosing the Right Trading Platform

Your choice of a trading platform is arguably the most crucial decision you will make. It’s the gateway to the market, so it needs to be reliable, secure, and user-friendly. In Dubai, traders are spoiled for choice with many globally recognized platforms and some fantastic homegrown options.

When evaluating your options, a trader’s focus will naturally turn to three things: regulation, security and asset variety. Choosing a platform licensed by a body like VARA or the DFSA is non-negotiable. This ensures the platform is subject to strict compliance and auditing standards.

Next, a strong security posture is a must, so look for features like cold storage for assets, two-factor authentication, and a proven track record of preventing hacks. Finally, a wide selection of cryptocurrencies is a key consideration. The best platforms provide a broad range of major coins and promising altcoins.

Some of the top rated crypto brokers and exchanges we have observed in the Dubai market include:

- Binance: The global giant is a powerhouse with high liquidity and over 600 cryptocurrencies. It is a fantastic choice for experienced traders who want advanced charting tools and a wide array of trading options.

- eToro: Regulated by multiple international authorities, eToro is a great choice for beginners due to its user-friendly interface and unique CopyTrader feature, which allows you to automatically replicate the moves of successful traders.

- Kraken: This platform is known for its strong security and is a great option for more experienced traders interested in leverage trading. The fact that it was one of the first international exchanges to get a full license in the ADGM is a testament to its commitment to the UAE market.

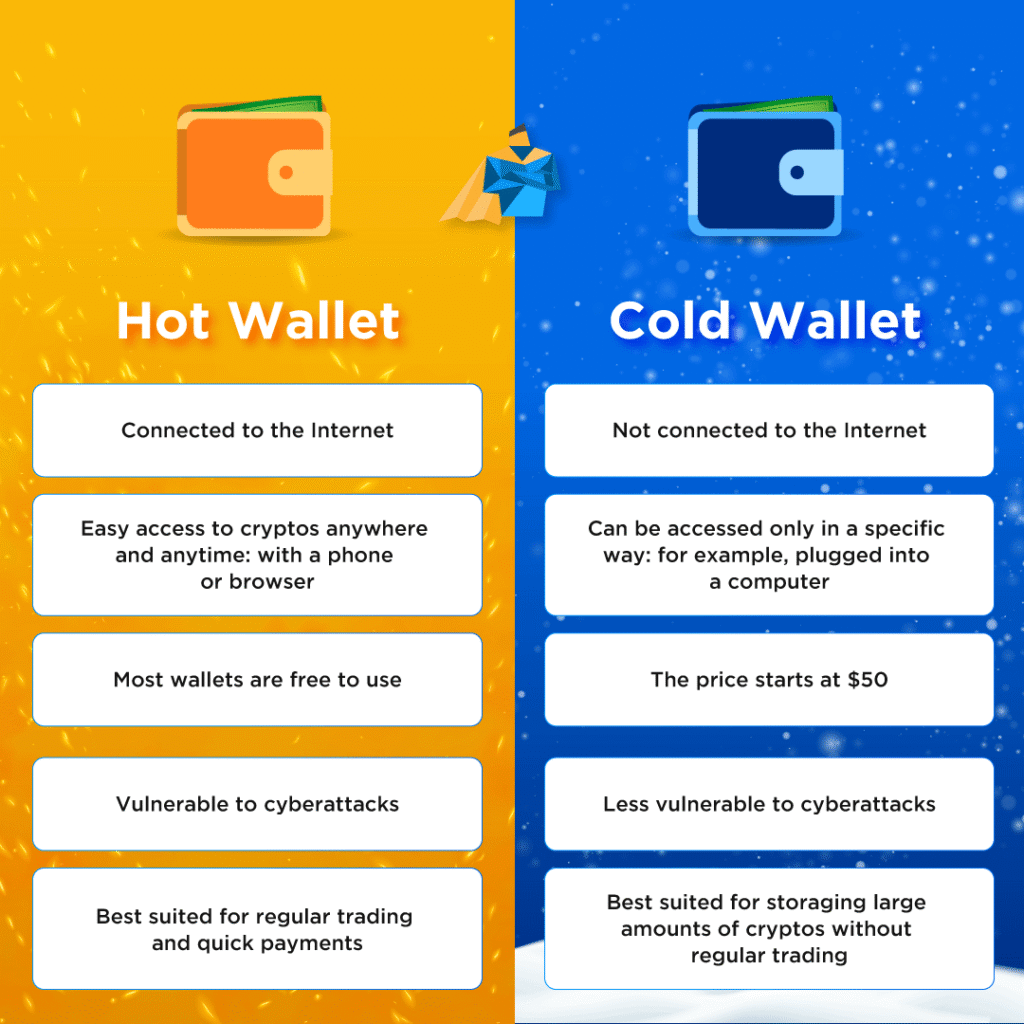

Understanding Digital Wallets

Once crypto is purchased, a safe place to store it is a must. This is where digital wallets come in. They are essential for securing your assets.

- Hot Wallets: These are online wallets connected to the internet. They are convenient for quick trades and transactions, as many exchanges provide them directly on their platforms. However, they are more susceptible to online hacks.

- Cold Wallets: These are physical hardware devices that store crypto offline, providing the highest level of security against hacks and malware. For long-term storage or significant holdings, a cold wallet is an absolute must. Think of it as your personal bank vault for crypto.

For most traders, a combination of both is the most effective strategy. A hot wallet for day-to-day trading and a cold wallet for long-term investments.

Funding Your Account and Placing Your First Trade

Opening an account is simple, usually requiring you to complete KYC (Know Your Customer) and AML (Anti-Money Laundering) checks. Once your account is verified, you can deposit funds. Many platforms in the UAE support direct bank transfers in AED, as well as debit and credit card payments. Just be mindful that some banks may restrict these transactions or charge higher fees.

After your funds are deposited, you are ready to trade. You will see a “buy” and “sell” price for each cryptocurrency. You can either open a long position (buying with the expectation that the price will rise) or a short position (selling with the expectation that the price will fall). Utilizing risk management tools like stop-loss orders to automatically close a trade if it moves against you is a prudent approach to protecting your capital.

Beyond the Basics

Crypto trading is much more than just buying and selling. The market’s volatility can create opportunities for traders, but it also comes with risk.

Active Strategies

- Day Trading: This strategy involves buying and selling crypto within the same day to capitalize on short-term price swings. It is a high-risk, high-reward approach that requires constant market monitoring and a deep understanding of technical analysis. The 24/7 nature of the crypto market means there are always opportunities.

- Margin Trading: This allows you to borrow funds from a broker to increase the size of your position, amplifying both potential profits and losses. It is a powerful tool for experienced traders who are confident in their market analysis.

- Arbitrage Trading: Prices for the same cryptocurrency can vary slightly across different exchanges. Arbitrage involves buying a coin on one exchange where the price is lower and immediately selling it on another where the price is higher, pocketing the small difference. This strategy requires speed and efficiency.

Passive Income Opportunities

The crypto market offers several ways to generate passive income where trading is not involved.

- Staking: This process involves holding or “locking up” your cryptocurrencies in a network’s consensus process to support its operations. In return for securing the network, you earn rewards, much like earning interest in a savings account.

- Yield Farming: This is a more advanced method where you contribute your crypto to a liquidity pool on a decentralized platform. By providing liquidity, you facilitate transactions and earn a portion of the fees, or new tokens, as a reward.

- P2E Games: For those who love gaming, this is a revolutionary concept. Play-to-Earn games reward players with crypto or NFTs for their in-game achievements and participation. Games like Axie Infinity and Decentraland have pioneered this space.

Why Dubai is a Global Crypto Hub

Dubai’s ambition to be a global leader in crypto is backed by concrete policies and actions. The city has become a beacon for crypto enthusiasts for several key reasons.

One of the most significant draws is the tax environment. For individuals, personal crypto trading in Dubai is entirely tax-free. This means no capital gains tax on your profits, regardless of the amount. For those who move to Dubai and establish residency, this offers a massive advantage over jurisdictions with high taxes. It is a clear and powerful incentive that attracts global talent. While businesses operating as a VASP may be subject to a low corporate tax, personal investors are exempt. This is a crucial distinction that makes Dubai a genuine tax haven for private traders.

Beyond taxes, the city has actively integrated blockchain technology. We have seen government agencies like Kiklabb start accepting crypto payments for licensing fees. Real estate developers are also embracing digital currencies for property sales. This real-world adoption builds a robust ecosystem and adds to the legitimacy of the space. Free zones like the RAK Digital Assets Oasis offer a business-friendly environment for startups, providing everything from streamlined licensing to tech support.

The Future is Now: What’s Next for Crypto in the UAE

We are on the cusp of another monumental shift: the launch of the UAE’s own digital currency. The Central Bank of the UAE has announced its plan to launch the “Digital Dirham” as part of its 2023-2026 strategy.

This move aims to modernize the financial system and position the country among the world’s top 10 central banks. The Digital Dirham will be a programmable central bank digital currency (CBDC) that could revolutionize payments, streamline compliance, and facilitate instant cross-border transactions. It signals a future where crypto and traditional finance are seamlessly integrated, with Dubai leading the way.

Frequently Asked Questions

Is Dubai good for crypto trading?

Yes, Dubai is excellent for crypto trading. The city offers a well-defined regulatory framework, zero personal income and capital gains tax on crypto profits, and a vibrant, business-friendly ecosystem. These factors combine to create a secure and appealing environment for both new and experienced traders.

Do I need a license to trade crypto in Dubai?

Individuals trading crypto for personal investment do not need a license. However, businesses or individuals who act as Virtual Asset Service Providers (VASPs), offering services like exchanges, brokerage, or custody, must obtain the necessary license from the appropriate regulatory authority, such as VARA or the DFSA.

How to start crypto trading in Dubai?

To start, one needs to choose a reputable and regulated crypto exchange or broker. Look for a top rated crypto broker licensed in the UAE. Next, you need to open an account and complete the required identity verification. Then, you can deposit funds, either through bank transfer or a credit card and begin trading crypto.

What do I need to know before starting crypto trading?

Before starting, it is essential to understand that crypto is a volatile asset class. Prudent traders do their own research, never invest more than they can afford to lose, and have a clear trading plan that includes risk management. It is also crucial to understand the difference between active trading and long-term investing, risks and to be aware of the security measures required to protect digital assets from hacks and scams.

26th Aug 2025

26th Aug 2025