Consolidation in Trading: Why Fast Execution Matters

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Summary

- Consolidation in trading is a sideways phase where price bounces between support and resistance, showing market indecision.

- Because ranges are tight, small costs like spread and small problems like slippage can matter more than traders expect.

- Fast, consistent execution helps you avoid getting picked off by false breakouts and missed fills, especially around the edges of the range.

- This guide covers consolidation patterns, how to trade in a consolidation market, and a real case study showing why patience and execution quality often decide the outcome.

Introduction

Consolidation looks calm on the chart. That calmness is misleading. When price is moving inside a tight box, your potential profit per trade is usually smaller, your invalidation level is usually closer, and your entry quality suddenly matters more than your opinions.

This is why execution becomes a serious topic during consolidation in trading. In a trend, traders can sometimes get away with a slightly late fill and still survive. In a range, a small delay, a small spread spike, or a small slip can turn a reasonable idea into a poor trade.

Consolidation in Trading: Meaning and Market Context

Consolidation meaning in trading

The consolidation meaning in trading is straightforward. Price fluctuates inside a defined range, often bouncing between support and resistance, without making sustained progress in either direction. This behavior reflects indecision, not inactivity.

The consolidation phase in trading

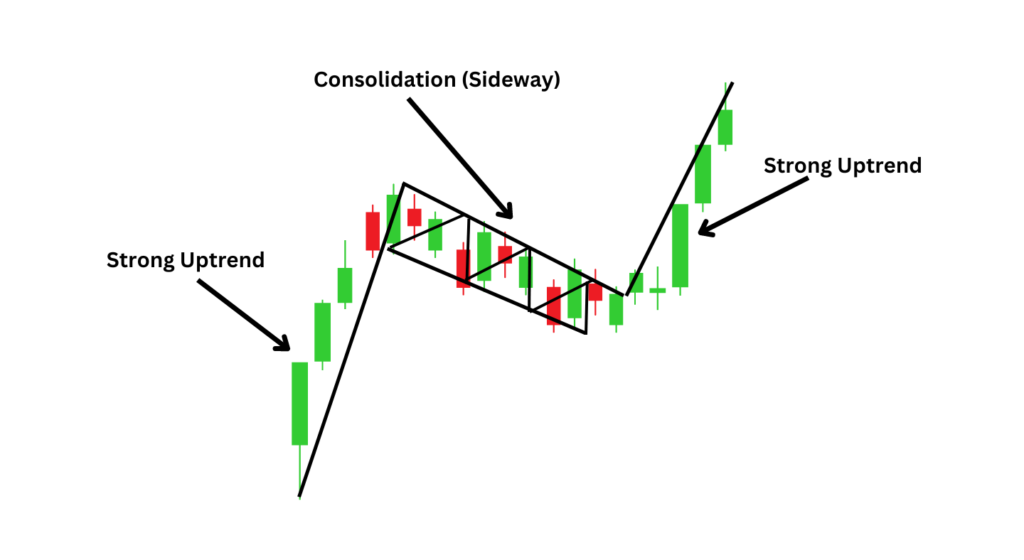

A consolidation phase in trading usually appears in three situations.

- After a strong move, when the market pauses and participants reassess.

- Mid-trend, where price forms a rest structure before potentially continuing.

- Before a new trend, as buyers and sellers position for the next directional move.

Consolidating in trading vs trending markets

When markets are consolidating in trading conditions, price is negotiating value within a zone. In trending markets, price shows acceptance in one direction. This difference matters because execution mistakes tend to hurt more when expected moves are small and stops are tight.

How a Consolidating Market Behaves

What is a consolidating market?

A consolidating market is rangebound. Price still fluctuates, but those moves are contained within upper and lower boundaries. Consolidation ends when price breaks and holds outside the range.

Support and resistance during consolidation

Support is the lower boundary where price repeatedly struggles to fall through. Resistance is the upper boundary where price repeatedly fails to push higher. In practice, these levels are zones rather than precise lines.

During consolidation, the edges of the range become decision points. This is where orders cluster, and it is also where execution quality becomes most visible.

Why consolidation signals indecision, not inactivity

Sideways price action usually reflects balanced buying and selling pressure. Some participants take profits, others enter positions, and larger players may be building or unwinding exposure.

The market is not idle. It is negotiating.

Key Takeaways for Beginners

- Consolidation in trading means sideways price within a defined range.

- False breakouts are common because many orders sit near range boundaries.

- Execution quality matters more when profit targets are smaller.

- Consolidations can be traded directly or used to prepare for the next move.

Exploring Market Consolidation Patterns

Most consolidation patterns are variations of the same idea. Price compresses or oscillates while the market waits for resolution. For beginners, it helps to group them into three practical categories.

Ranges and sideways markets

Ranges are defined by horizontal support and resistance. The main risk is the false breakout, where price briefly moves outside the range and then returns. Waiting for price to hold outside the range, rather than reacting to the first spike, can reduce this risk.

Flags as trend pauses

Flags form during trends and often represent pauses rather than reversals. Beginners often misread them as trend endings, while they are frequently continuation structures.

Triangles, pennants, and wedges

These patterns reflect compression, where highs and lows converge. Compression often leads to volatility expansion once price breaks out, making execution timing more important.

Why Fast Execution Matters in Consolidation in Trading

Execution is not only about raw speed. It is about consistency and reliability. In consolidation, small inefficiencies can have an outsized impact on results.

Tight ranges leave less room for error

When targets are small, costs become a larger percentage of the trade. Slightly worse entries or exits can materially change the risk-to-reward profile. This is why traders often feel correct on direction but disappointed with outcomes during consolidation.

Slippage and spread sensitivity in consolidation

Slippage can occur during sudden spikes, stop runs, or breakout attempts. These moments are common around consolidation boundaries. Even though the broader market is quiet, these brief bursts are where execution quality matters most.

Why slow or inconsistent execution increases false breakout pain

False breakouts are part of trading. Poor execution makes them costly. Late fills, widened spreads, or missed retest entries often turn manageable losses into frustrating ones.

What good execution looks like during consolidation

- Stable spreads during normal conditions.

- Predictable fills near support and resistance.

- Clear handling of market, limit, and stop orders during fast moves.

A Real Consolidation Case Study: Melrose Industries

Melrose Industries provides a clear example of consolidation. From mid 2012 to 2016, the stock traded inside a relatively fixed range between roughly 43 and 61 before breaking out.

Why this is consolidation

Over several years, price repeatedly oscillated inside the same horizontal boundaries instead of trending higher or lower. This extended sideways movement reflects a classic consolidation phase in trading.

What happened after the range

Once price closed and held above the upper boundary, the stock entered a strong trending move, more than doubling within months and continuing higher thereafter. This highlights a common market behavior. Long consolidations can precede powerful moves.

The execution lesson from this case

Obvious ranges attract attention and cluster orders. When the breakout finally happens, execution quality often determines whether traders capture the move or enter at poor prices.

How to Trade in a Consolidation Market

There are three main approaches to how to trade in consolidation market conditions.

- Range trading inside the range.

- Breakout trading when price escapes.

- Retest trading after the breakout.

Range trading inside the box

Range trading focuses on entries near support and resistance rather than the middle of the range.

Clear invalidation levels and realistic targets are essential.

Range trading framework

- Mark zones using multiple touches.

- Enter near edges, not in the middle.

- Define where the idea is invalid.

- Keep targets proportional to the range.

Breakout trading

Breakout trading aims to capture the first move out of consolidation. It offers strong potential but comes with false breakouts. Waiting for confirmation rather than reacting instantly can reduce damage.

Retest entries

Retest trading waits for price to return to the broken level. This approach often improves entry quality and reduces the likelihood of chasing spikes.

Minimal Confirmation Tools

Volume behavior

Rising volume near range boundaries can signal genuine interest. Weak volume during a breakout attempt can warn of failure.

Length and width of the consolidation

Longer and tighter consolidations tend to build pressure. However, obvious ranges also invite traps, making patience critical.

Retest behavior

A successful retest often provides clearer confirmation than the initial breakout spike.

Execution and Broker Perspective

During consolidation, the market offers little margin for error. Broker execution behavior becomes a larger factor in overall performance. Stable spreads, reliable order handling, and consistent fills matter more than marketing claims.

A Brief Note for UAE and GCC Traders

For traders based in the UAE and GCC, execution can vary depending on trading hours and liquidity conditions. Testing strategies during the hours you actually trade is essential, especially in consolidation where assumptions are punished.

Common Beginner Mistakes During Consolidation

Overtrading the middle of the range

The middle often offers poor reward-to-risk. Many losses come from trades taken without structural advantage.

Assuming every breakout is real

False breakouts are normal. The goal is to manage their impact, not eliminate them entirely.

Ignoring execution until it becomes a problem

Execution quality often explains the gap between backtested ideas and real results, especially in rangebound markets.

Practical Checklist

- Identify clear support and resistance zones.

- Choose a range, breakout, or retest approach.

- Define invalidation before entering.

- Avoid the middle of the range.

- Track real fills versus planned prices.

- Review execution behavior if results disappoint.

Conclusion

Consolidation in trading is not dead time. It is a precision environment.

When price is rangebound, profits are smaller and mistakes are more costly.

That is exactly why fast, consistent execution matters.

Structure first. Confirmation second. Execution always.

FAQs

Is it good when a stock consolidates?

Often, yes. Consolidation can be a healthy pause that allows the market to digest prior moves.

Whether it is attractive depends on whether you are trading the range or waiting for the next trend.

How to avoid consolidation in trading?

If consolidation does not suit your style, focus on markets showing clear directional structure and avoid instruments stuck between repeated support and resistance levels.

Is consolidation of shares a good thing?

Share consolidation is a corporate action that changes the number of shares and price proportionally.

It does not automatically improve value. Always evaluate the underlying structure and liquidity after such events.

Disclaimer: This content is for educational purposes only and not to be construed as investment advice. Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

16th Dec 2025

16th Dec 2025