The Best UAE Mobile Apps for Professional CFD Traders Who Trade Daily

Sam Reid · Senior Financial Markets Analyst

Staff Writer

Sam Reid · Senior Financial Markets Analyst

Staff Writer

Summary

- We compare the best UAE mobile apps for professional CFD traders based on execution control, order types, platform stability, spreads, and risk tools.

- We keep suggestions tight and practical: Exness, XTB, and XM only.

- We also cover UAE-specific reality: DIFC and DFSA oversight, retail protections like negative balance protection, and why margin rules matter on mobile.

- You get a clear decision path, a side-by-side table, and mobile workflows you can copy for daily trading.

The best UAE mobile apps for professional CFD traders are the ones that let you enter, manage, and exit positions with calm precision while the market is moving fast.

Mobile has changed the game. Not for casual trading, for serious trading. If you are a professional CFD trader in the UAE, your phone is no longer a backup screen. It is a risk terminal in your pocket, and it needs to perform like one!

What “professional mobile trading” actually means in the UAE

When we say “professional,” we are not talking about vibe or aesthetics. We are talking about outcome-driven behavior: consistent execution, tight risk control, and the ability to manage positions across sessions without losing context.

The UAE reality: regulation, protections, and why it matters on a phone

UAE traders often interact with brokers operating under different regulatory setups, including entities associated with Dubai’s financial ecosystem. In Dubai’s financial zone, the DFSA framework is widely referenced for oversight standards and retail protections, and it has shaped how leverage, margin close-outs, and safeguards are presented to clients.

For retail clients under DFSA-style rules, two points matter a lot when you trade CFDs on mobile:

- Negative balance protection is designed to limit your maximum loss to funds in your account.

- Automatic close-out rules can trigger if your equity falls below a threshold tied to margin requirements, which is why real-time monitoring tools on mobile are not optional.

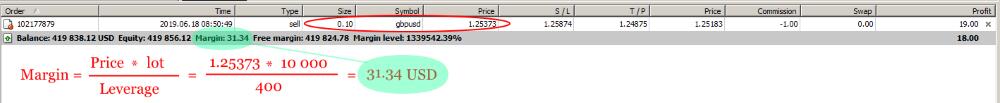

Also, leverage differs by asset class in many regulated environments. On mobile, this is not theory. It changes your position sizing, your stop placement, and how quickly a trade can go from “fine” to “forced close.”

How we picked the best UAE mobile apps for professional CFD traders

We used a simple filter: if a platform cannot reliably support daily CFD workflows, it is out. The best mobile app for a professional trader is not the one with the most buttons. It is the one that reduces operational mistakes under pressure.

Our scoring criteria (what matters most for daily CFD trading)

- Execution control: ability to place, modify, and cancel orders quickly with clear confirmations.

- Order types: market, limit, stop, stop-limit (where supported), trailing stops, partial closes.

- Stability under volatility: app responsiveness when markets spike and spreads widen.

- Risk tools: position sizing visibility, margin level clarity, alerts, and account health tracking.

- Charting and context: clean multi-timeframe workflow, watchlists, and easy symbol switching.

- Costs that show up daily: spreads, commissions, overnight financing, and how transparently they are displayed.

- UAE practicality: onboarding, support quality, and a realistic experience for UAE-based traders.

Quick answer: the 3 apps to check out in the UAE

We suggest Exness, XTB, and XM, because each can realistically fit a professional’s daily CFD routine, depending on how you trade.

Best overall “daily execution workflow” on mobile: Exness

If your priority is getting in and out cleanly, managing positions without friction, and maintaining a fast daily routine, Exness is the most natural fit for many active CFD traders. The key is consistency. You want the same steps, the same controls, and no surprises when the market moves.

Best “analysis-to-execution” flow on mobile: XTB

XTB tends to appeal to traders who want a polished experience and a smoother bridge between analysis and action. If your day includes scanning multiple markets and reacting quickly, the mobile workflow matters as much as spreads.

Best “accessible pro routine” with broad instrument coverage: XM

XM is often positioned as a strong option for UAE traders who want a low barrier to entry, platform familiarity through MT4/MT5, and broad instrument access. If you run multiple small-to-mid strategies and want a straightforward, repeatable routine, XM can fit well.

Side-by-side comparison table (made for UAE-based daily traders)

Use this table like a shortlist tool. Pick the row that sounds like your real day, not the day you wish you had.

| What you care about most | Exness | XTB | XM |

|---|---|---|---|

| Fast daily execution and position management | Excellent | Very strong | Strong |

| Clean mobile UI that reduces mistakes | Strong | Excellent | Good |

| Platform familiarity (MT4/MT5 ecosystem) | Yes (depending on setup) | Depends on account/platform choice | Yes |

| Daily routine with alerts and risk tracking | Excellent | Very strong | Strong |

| Best fit for “trade, manage, exit” repeated all day | Top pick | Runner-up | Solid alternative |

The daily mobile workflow

Professional trading is repetitive by design. That is a compliment. When the market gets loud, your process should stay quiet.

Step 1: Build a “3-screen” mobile routine

- Screen 1: Watchlist with only the instruments you actually trade (Gold, Oil, major FX, key indices).

- Screen 2: Chart with one clean template (levels + one momentum confirmation).

- Screen 3: Positions tab showing margin level, floating P&L, and stop-loss status.

Step 2: Predefine order behavior

On mobile, hesitation costs. Decide order type in advance:

- When you use market orders (speed matters more than perfect entry).

- When you use limit orders (price control matters more than getting filled).

- How you manage exits: partial close, trailing stop, or hard target.

Step 3: Treat margin level as a live metric

If you trade leveraged CFDs, margin is not background information. It is your survival line. Use alerts. Check it during volatility. Do not rely on memory.

What UAE-based pros should watch closely (costs, leverage, and protections)

Two traders can take the same setup and get different outcomes simply because of costs and execution. That is why we focus on what you will feel every day.

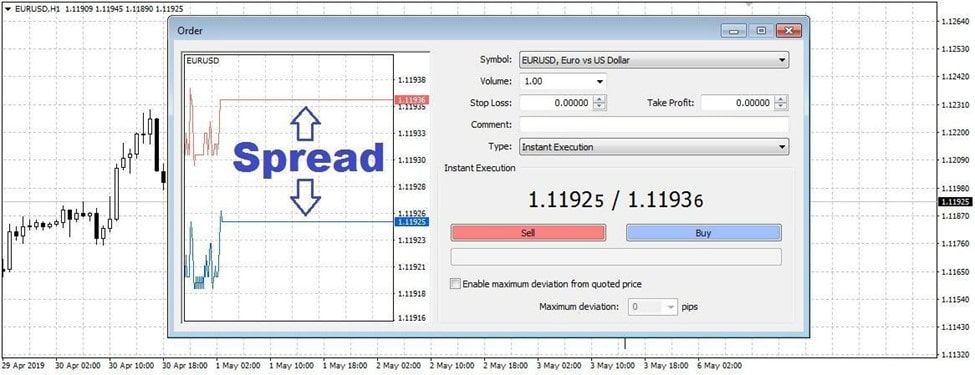

Spreads and commissions: what matters in practice

If you trade frequently, spreads are not “small.” They are repeated. On instruments like Gold and Oil, a tighter spread environment can change your monthly performance more than a new indicator ever will.

What we look for:

- Spreads that behave reasonably during high-activity periods

- Clear cost visibility before you place the trade

- No confusing surprises when you review trade history

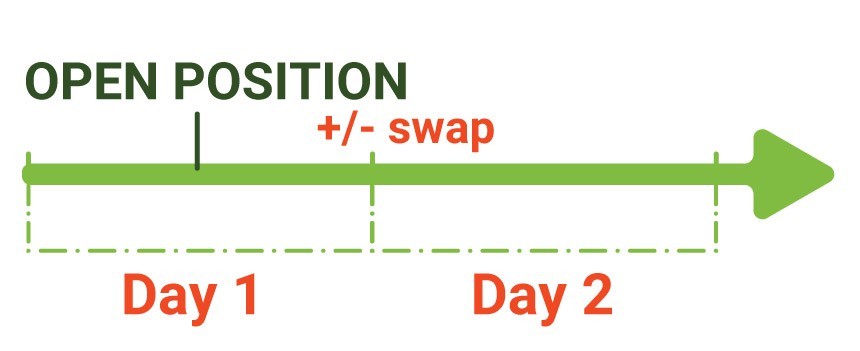

Overnight financing: avoid accidental “position drift”

Many UAE-based traders start as intraday traders and slowly drift into holding positions overnight. It happens quietly. Then financing costs appear and performance looks strange.

If you are truly trading daily, build a habit: if a trade is not meant to swing, close it before rollover. Simple. Powerful.

Negative balance protection and why pros still respect it

Even experienced traders can get caught in extreme gaps. Mobile traders are particularly exposed when they are away from a stable setup. Retail protections like negative balance protection exist for a reason, but do not treat them like a strategy. Treat them like a seatbelt.

Which app should you choose? A practical decision path

Choose Exness if you are execution-first

- You trade frequently and need quick position management.

- You care about reducing friction between “see it” and “place it.”

- You want a daily routine that is repeatable and calm.

Choose XTB if you are analysis-driven but still fast

- You scan multiple markets and want a smoother research-to-trade flow.

- You value a polished interface that reduces mis-click risk.

- You want an app experience that feels built for active decision-making.

Choose XM if you want a straightforward pro routine with broad access

- You want familiar platform behavior and a structured trading environment.

- You are active, but you also value accessibility and support.

- You want a clean path from onboarding to consistent daily execution.

UAE-specific use cases (real actions you can take)

Let’s keep this grounded in what UAE-based traders actually do.

Use case 1: Trading Gold during Gulf time zones

Gold is popular in the region. Daily traders often trade it around major economic releases or as volatility appears during overlapping sessions. Your mobile app must let you adjust stops quickly and avoid confusion during fast moves.

Use case 2: Trading Oil when headlines hit

Oil can move sharply on news. If you trade it, your platform needs stable order modification and clear margin impact. You do not want to be calculating margin in your head while price is moving.

Use case 3: Managing open positions while you are out

Mobile trading is often “real life” trading. Meetings, commuting, travel. The best professional apps are the ones that help you cut risk fast when you cannot babysit a chart.

What to test before you commit real size

Even if you already trade professionally, test the mobile experience like you are stress-testing a tool, not trying to like it.

- Order placement test: place and cancel orders quickly. Check confirmations.

- Stop-loss editing test: modify stops multiple times on a moving market.

- Connectivity test: switch networks (Wi-Fi to 5G) and see how the app behaves.

- History and reporting test: review costs and execution after trades close.

- Alerts test: set price alerts and margin alerts and confirm they actually help you act.

Our shortlist conclusion

If your goal is to trade CFDs professionally from the UAE using mobile as a primary tool, the shortlist stays simple:

- Exness for daily execution, fast management, and a clean routine.

- XTB for a strong analysis-to-execution mobile experience and a polished interface.

- XM for accessible professional routines and broad market coverage.

Pick the one that matches your real trading day. Then build your routine around it. That is how mobile trading becomes professional, not chaotic.

FAQs

Can you trade CFDs in Dubai and the UAE?

Yes. CFD trading is widely available in the UAE through brokers that operate under relevant regulatory frameworks and licensing structures. The key is choosing a broker with clear regulatory standing and strong client protections.

Who regulates CFD trading platforms in Dubai?

Dubai’s financial zone is commonly associated with DFSA oversight standards. Across the UAE, traders will also see references to other regulatory authorities depending on where the broker is licensed and operates. Always confirm the exact legal entity and regulator listed on your account opening documents.

Do UAE CFD platforms offer negative balance protection?

Many retail frameworks include negative balance protection as a safeguard designed to limit losses to the funds in your account. Even with this protection, disciplined risk management remains essential, especially during volatile moves and market gaps.

What leverage can retail traders typically access in Dubai?

Leverage depends on the broker entity and the asset class. In many DFSA-style retail environments, leverage can be higher on major FX pairs, indices, and certain commodities, and lower on shares and crypto. Always check the margin schedule inside your account before trading.

Which mobile app is best for professional CFD traders in the UAE?

For our UAE-focused professional CFD criteria, check out: Exness for execution-first daily routines, XTB for a strong analysis-to-trade mobile flow, and XM for a structured and accessible professional setup.

Disclaimer: This content is for educational purposes only and not to be construed as investment advice. Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

15th Jan 2026

15th Jan 2026