Can I Buy Shares in Saudi Arabia?

Sam Reid Staff Writer

Sam Reid Staff Writer

Understanding the Saudi Stock Exchange

The Saudi stock exchange, officially known as Tadawul, stands as the backbone of the Kingdom’s capital market. It represents one of the largest exchanges in the Middle East, providing a platform for investors to buy and sell shares of more than two hundred listed companies across a variety of sectors. Over the years, Tadawul has played an important role in strengthening corporate governance and promoting transparency within the Saudi economy.

The exchange is regulated by the Capital Market Authority, which ensures that trading practices remain fair, efficient, and compliant with international standards. Investors benefit from the high liquidity and diversity offered across industries such as banking, energy, healthcare, telecommunications, and technology.

Who Can Invest in the Saudi Stock Exchange

The market is open to different investor categories depending on their profile and eligibility. The Capital Market Authority provides specific entry pathways to encourage participation while maintaining oversight and stability.

Qualified Foreign Investors

Institutional investors with a legal personality, including banks, insurance companies, and investment funds, can apply as qualified foreign investors. These institutions must manage assets worth at least five hundred million United States dollars or an equivalent of one billion eight hundred seventy five million Saudi Riyals. Government related entities can also apply and are exempt from this minimum asset requirement.

Foreign Strategic Investors

Foreign entities that wish to own a strategic share in Saudi listed companies can invest through this route. The goal is to enhance financial and operational performance rather than short term speculation. There is no limit on ownership percentage, but investors are required to hold their shares for two years before selling them.

Swap Holders

Capital market institutions that are licensed in Saudi Arabia may enter into swap agreements with non resident clients. These arrangements transfer the economic benefits of share ownership without transferring legal title, allowing international participants to gain market exposure.

Foreign Residents

Individuals living in Saudi Arabia who hold a valid residency permit and an active local bank account can open trading accounts with licensed investment banks. This allows foreign residents to participate directly in the market just like Saudi citizens.

How to Open an Investment Account

To start trading in the Saudi stock exchange, investors need to complete several essential steps. The process is structured and aims to ensure that only verified and legitimate participants access the market.

- Choose a Licensed Brokerage: Select a brokerage authorized by the Capital Market Authority. Always verify the company’s license before proceeding.

- Submit the Required Documents: This includes identification, proof of address, bank account verification, and a completed know your customer form.

- Sign Agreements: The investor must review and sign all terms and conditions governing the brokerage relationship.

- Activate and Fund the Account: Activation usually happens through a local bank transfer or direct deposit.

- Access the Trading Platform: Investors can monitor prices, view financial data, and place buy or sell orders through secure web or mobile platforms.

Investment Strategies for Beginners

Each investor has a unique risk appetite and time horizon. Beginners are advised to start with a clear plan and realistic expectations.

Long Term Holding

This approach involves selecting quality companies with solid fundamentals and holding their shares for several years. The goal is to achieve gradual capital growth rather than short term gains.

Value Investing

Investors using this method seek stocks that appear underpriced relative to their intrinsic value. The potential reward comes when the market eventually recognizes the true worth of the company.

Dividend Investing

Some investors prefer companies that pay consistent dividends. These payouts provide a stable source of income and can help balance market volatility.

Diversification

Spreading investments across sectors or regions reduces exposure to risk from a single company or market event. The Saudi stock exchange offers opportunities in finance, manufacturing, energy, and emerging technology sectors.

Evaluating Companies Before Investing

Before purchasing shares, investors should analyze the financial health and performance of a company. Two popular approaches help guide this process.

Fundamental Analysis

This examines a company’s core performance indicators such as revenue, debt levels, profitability, and management quality. Reviewing quarterly and annual reports is vital for making sound investment decisions.

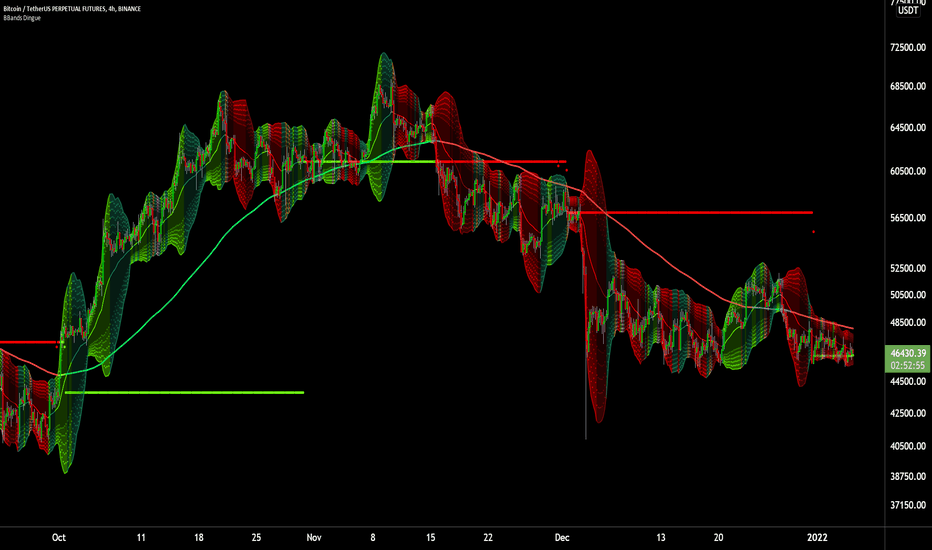

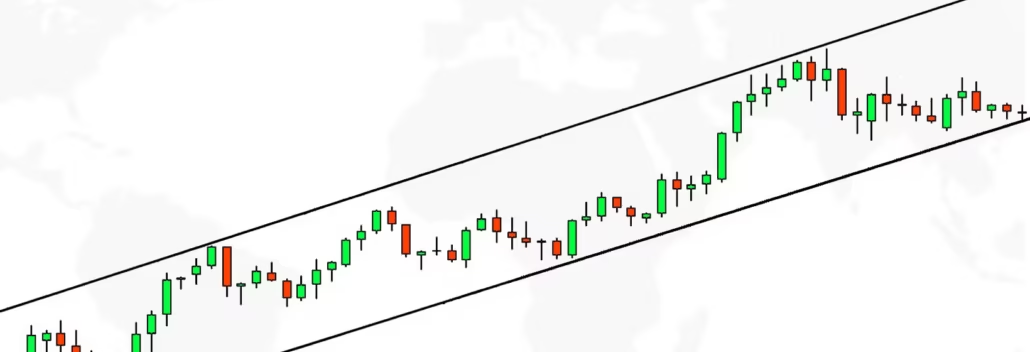

Technical Analysis

Technical analysis relies on price charts, volume data, and patterns to predict potential price movements. While it focuses on short term behavior, combining it with fundamental analysis provides a balanced perspective.

Risks to Consider in the Saudi Market

Investing in shares always carries an element of risk. Understanding these risks helps investors make measured decisions.

- Market Volatility: Prices may fluctuate due to global or local economic factors. Long term investors often manage this by staying focused on overall growth rather than short term swings.

- Liquidity Risk: Some smaller companies may have limited trading volumes, making it harder to sell shares quickly at desired prices.

- Company Specific Risk: Poor earnings, leadership changes, or legal disputes can affect share value.

- Macroeconomic Factors: Global oil prices, interest rate changes, and regional developments can influence market performance.

How Foreigners Can Participate

Foreign participation in the Saudi stock exchange follows clear regulatory limits. A single foreign investor may own up to five percent of shares in one company, while all foreign investors together cannot exceed forty nine percent of any firm’s total shares. Qualified foreign investors as a group are limited to twenty percent of a company’s stock and ten percent of the total market capitalization.

These rules ensure that local ownership remains dominant while allowing global investors to benefit from the Kingdom’s economic expansion. Investors who do not qualify directly can still gain exposure through exchange traded funds that track Saudi companies listed on international exchanges.

Learning and Market Monitoring

Continuous learning is a key part of long term success. Investors are encouraged to follow official news updates, review analysis from credible sources, and regularly monitor their portfolios. Many online platforms provide educational resources that cover both local and international market trends.

Emotional Control and Risk Management

Trading decisions driven by emotion can lead to poor outcomes. Patience, discipline, and adherence to a well structured plan are essential. Investors should avoid borrowing money to invest, as it can magnify losses during downturns. Keeping investments within affordable limits ensures stability and sustainability.

Building a Balanced Portfolio

A successful portfolio is one that aligns with the investor’s goals and risk tolerance. Setting clear objectives, diversifying across sectors, and reviewing performance regularly helps maintain balance. Over time, informed decision making and persistence can lead to steady financial growth through participation in the Saudi stock exchange.

Conclusion

Buying shares in Saudi Arabia is possible for both local and qualified foreign investors who meet the necessary requirements. The Saudi stock exchange offers a structured and transparent environment supported by strong regulation. While there are restrictions on ownership and access, the market continues to evolve and expand. With careful research, sound strategy, and a focus on long term growth, investors can build meaningful exposure to one of the Gulf’s most influential economies.

FAQs

How can I buy shares in Saudi Arabia?

You can buy shares by opening an investment account with a licensed brokerage authorized by the Capital Market Authority. After completing identification and account setup, you can begin trading through the brokerage’s platform.

Can I invest in Saudi Arabia for foreigners?

Yes, foreign investors can participate through qualified foreign investor programs, swap arrangements, or by purchasing exchange traded funds that include Saudi companies.

Is trading allowed in Saudi Arabia for foreigners?

Trading is allowed under specific rules set by the Capital Market Authority. Institutional investors and foreign residents with residency permits can trade directly, while others may use approved investment channels.

Is Saudi Arabia a good place to invest?

Saudi Arabia presents attractive long term opportunities thanks to its economic reforms, diversification efforts, and stable financial infrastructure. Investors seeking exposure to the Middle East often view it as a key market for growth.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose. This content is for educational purposes only and should not be interpreted as investment advice or a sufficient basis for making investment decisions.

01st Nov 2025

01st Nov 2025