Is XAUUSD Difficult to Trade?

Sam Reid Staff Writer

Sam Reid Staff Writer

Understanding XAUUSD Trading

The gold versus US dollar pair, XAU/USD, is one of the most traded assets worldwide. It represents how much US dollars are needed to buy one ounce of gold. Because gold acts as both a commodity and a monetary benchmark, its price reacts to inflation data, central bank actions, and global uncertainty.

What makes xauusd trading both fascinating and challenging is that gold often moves differently from other forex pairs. When traders move capital out of risky assets, they often buy gold, which drives prices higher. When confidence returns, gold may drop sharply. Managing this rhythm of fear and optimism is essential for success.

Why Gold Feels Different to Trade

1. Gold is a global sentiment gauge

Unlike forex pairs that respond mostly to data releases, gold reacts strongly to global emotion. Fear of inflation, conflict, or financial stress can cause price spikes. Confidence can send gold lower. During 2024, central banks bought over 1,045 tonnes of gold, underscoring its importance as a hedge. Such large-scale activity frequently drives price surges and short-term volatility.

2. The US Dollar Connection

Gold and the dollar usually move in opposite directions. When the dollar strengthens, gold tends to fall; when the dollar weakens, gold rises. This correlation means traders must monitor Federal Reserve statements, inflation figures, and other US economic indicators. For example, expectations of rate cuts can boost gold as investors anticipate weaker returns on dollar assets.

3. Volatility and Liquidity

Gold is among the most liquid instruments globally, with enormous daily trading volume. High liquidity means fast execution, but volatility can be intense. Prices can swing several dollars within minutes during high-activity sessions like the London–New York overlap. Many traders see opportunity in these movements, but uncontrolled leverage can quickly magnify losses. A clear risk plan, such as limiting exposure to 1–2% of account balance per trade is crucial for long-term results.

Key Factors That Move Gold

1. Inflation and Interest Rates

When inflation rises, investors often turn to gold for protection. But if central banks raise interest rates aggressively, gold may drop as higher yields make bonds more attractive. Watching global inflation trends and monetary policy updates can provide early signals of directional shifts.

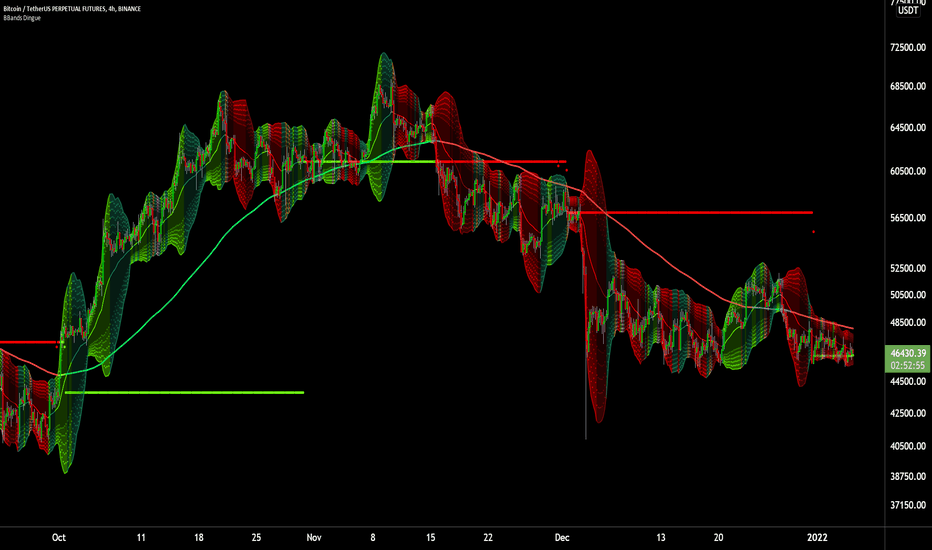

Interest rate effect on gold example. (TradingView)

2. Central Bank Activity

Central banks’ gold purchases often influence sentiment. When countries diversify away from the dollar, demand for gold increases. Traders monitoring these moves can better anticipate momentum in XAUUSD prices.

3. Geopolitical Risk

Events like wars, elections, or sanctions can create rapid surges in gold prices. The Russia–Ukraine conflict in 2022 triggered one of the decade’s strongest rallies. Such events create opportunity but also heighten risk, requiring tighter stop losses and disciplined trade management.

4. Industrial and Jewellery Demand

Beyond being a safe-haven asset, gold serves real-world industries. Rising jewellery and electronics demand can lift prices even when markets are stable. Understanding seasonal or regional demand patterns can help traders identify longer-term trends.

Is XAUUSD Hard to Trade?

The honest answer: yes, at first. Gold is influenced by many simultaneous factors—currencies, global events, and investor sentiment. Beginners may find it unpredictable because price patterns often “overshoot” before stabilising. Yet once traders understand these dynamics, they can use volatility to their advantage.

Success in xauusd trading relies on preparation rather than prediction. The essentials include:

- Avoiding excessive leverage

- Using clear entry and exit plans

- Accepting volatility as normal, not as a surprise

- Relying on disciplined money management

With the right structure and patience, gold trading becomes more manageable and potentially rewarding.

Best Hours to Trade XAU/USD

Gold trades 24 hours from Monday to Friday, but activity varies. The London–New York overlap (1 PM–4 PM GMT) is the most active, offering tighter spreads and faster fills. Asian sessions are quieter and may suit traders seeking calmer price action. During these hours, liquidity is lower, so spreads widen and price gaps can occur.

Practical Strategies for Gold Traders

1. Trend-Following Approach

Identify the prevailing direction and align trades with it. Traders often use moving averages or trend lines for confirmation. If gold’s price keeps making higher highs, look for pullbacks to buy. If lower lows dominate, search for short opportunities.

2. Breakout Strategy

When prices move beyond clear support or resistance levels, strong momentum can follow. Waiting for confirmation candles or volume spikes can help reduce false signals. Stop losses are typically placed just outside the breakout zone.

3. RSI and Fibonacci Confirmation

Indicators like RSI (Relative Strength Index) or Fibonacci retracements can help confirm potential turning points. For instance, when gold retraces to the 50% Fibonacci level while RSI rises from oversold, some traders see it as a potential buying setup. Use these tools as part of a broader plan, not in isolation.

4. Risk Management First

Gold’s volatility demands strong capital control. Always use stop-loss orders, keep position sizes modest, and maintain emotional balance. Even seasoned traders can lose money without discipline. Consistent success comes from managing downside risk, not chasing every rally.

Choosing Reliable Gold Trading Brokers in the UAE

For traders in the GCC, access to trusted platforms matters. Regulated gold trading brokers in UAE such as Exness provide transparent pricing, fast withdrawals, and access to local deposit options like Mada or Wio Bank transfers. Exness also offers competitive spreads on XAUUSD, making it suitable for both short-term and long-term traders who want to participate in the gold market efficiently.

Before selecting any broker, confirm their regulation, available account types, and swap-free options for Islamic accounts. These factors ensure compliance and reduce unnecessary trading costs.

Conclusion

Trading gold through the XAUUSD pair is one of the most dynamic opportunities in the global market. It combines high liquidity with emotional price behavior tied to global uncertainty. While difficult for those expecting stability, it rewards traders who learn to navigate volatility with logic and patience.

By understanding what drives gold, choosing the right broker, and applying consistent risk management, traders can turn XAUUSD into a cornerstone of a balanced portfolio.

FAQs

Why is XAUUSD hard to trade?

XAUUSD can be more volatile due to geopolitical factors and shifts in market sentiment, which can create both opportunities and risks. Additionally, the correlation between gold and other assets, like currencies or stocks, can influence trading strategies.

Is trading XAUUSD better than forex pairs?

Gold often moves independently of major currencies, offering diversification benefits. However, its volatility can be higher than typical forex pairs, meaning careful position sizing and risk control are essential.

Is trading XAUUSD good for beginners?

Yes, but only with practice and risk management. Beginners should start with demo accounts or micro lots to understand price behavior before using leverage. Gold rewards discipline more than speed.

How to successfully trade XAUUSD?

Follow the trend, use support and resistance levels, monitor USD data and interest rates, and always apply stop losses. Avoid emotional decisions and trade only when your setup criteria are met.

How much money do you need to trade XAUUSD?

Some brokers allow trading with deposits as low as 100 to 500 USD using micro lots (0.01). Starting small helps you learn position sizing and margin management while limiting potential losses.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose. This content is for educational purposes only and should not be interpreted as investment advice or a sufficient basis for making investment decisions.

31st Oct 2025

31st Oct 2025