How to Buy Shares Online

Sam Reid Staff Writer

Sam Reid Staff Writer

Owning shares means owning a stake in a company’s future. You could be sitting in a cafe, logging into your broker’s app and placing an order for Emaar or ADNOC in just a few clicks.

The buying process itself can be straightforward once your account is set up. It often takes only minutes to place an order. The decision of which shares to buy is very different. That choice should follow careful research, an understanding of the company and a clear view of how it fits into your financial goals.

This guide will walk you through the exact steps to buy shares online in the UAE. It will explain the requirements unique to this market, show you how to evaluate opportunities, and give you examples so you can approach your first purchase with confidence and clarity.

What Does Buying Shares Online Actually Mean

When you buy shares online, you use a licensed broker’s platform to place an order that purchases part‑ownership in a company. Your order goes into the market and, once matched, you become a shareholder.

Online trading allows you to skip physical paperwork and monitor your investment in real time. You can do it from your computer, tablet or phone.

For UAE residents, there are additional steps such as obtaining a National Investor Number (NIN) for local markets. Once that is in place, you can trade local and global shares from one or more accounts.

Step-by-Step: How to Buy Shares Online in the UAE

1. Get Your Investor Number (NIN)

In the UAE, you need a National Investor Number (NIN) to trade on DFM, ADX or Nasdaq Dubai.

You can apply for it through the exchange or your broker. Requirements usually include:

• Emirates ID

• Completed NIN application form

• Sometimes a passport copy for expats

Your NIN links all your market trades and holdings under your name. The process is quick and often done in a day.

2. Choose a Licensed Broker

You can open an account with:

• Local brokers licensed by the Securities and Commodities Authority (SCA)

• UAE banks with brokerage services

• International brokers that accept UAE residents for foreign markets

Look for:

• Markets offered (local, regional, international)

• Trading and account fees

• AED funding and withdrawal options

• Mobile and desktop usability

• Customer support

For instance, UAE brokers often clear DFM trades faster, while international platforms may offer lower fees for US investments.

3. Fund Your Account

Common UAE funding methods include:

• Local bank transfer

• Debit card

• Payment systems like Mada or STC Pay

• International wire for foreign brokers

Using AED for local trades avoids conversion fees. For foreign trades, compare conversion rates first.

4. Research the Shares

This is the heart of your investment decision. Effective research includes:

• Fundamentals: revenue, profit margin, debt, growth

• Technicals: price trends, volume, moving averages

• Sector trends: are your target stocks aligned with growth industries?

• Dividends: if you’re seeking income, check yield and consistency

Use DFM and ADX websites to access company financials and announcements. For example, an ADNOC announcement could impact price.

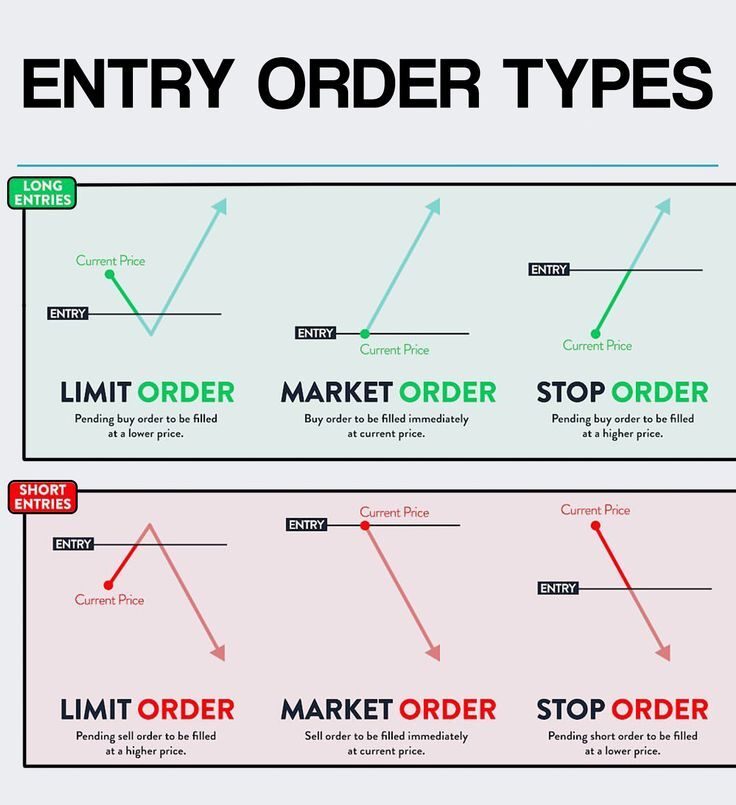

5. Choose Your Order Type

• Market order – executes at the current best price

• Limit order – executes only at your chosen price

• Stop order – triggers a market order if the stock hits a set price

Beginners often prefer limit orders to control buying price.

(Entry Order Types)

6. Place the Order and Confirm

Enter the stock’s ticker, amount, and order type. Double-check all details and fees before confirming.

7. Track Your Investment

After execution, monitor your holding via the broker’s platform. Set alerts for important price levels or news updates.

Example: Buying Apple Shares from the UAE

Here’s how an international investment might work:

-

Fund an international brokerage account from the UAE

-

Place a buy order for 50 Apple shares

-

Cost breakdown:

-

Stock cost: 50 × 233.33 = USD 11,666.50 (AED 42,857 at AED/USD 3.675)

-

Broker commission at 0.1% = USD 11.67 (AED 43)

-

Currency conversion fee at 0.5% = AED 214

-

-

Total cost: AED 43,114

-

Average cost per share: AED 862.28

This example shows how fees and currency conversions impact the total cost and your effective entry price.

Choosing the Right Broker: UAE vs International

UAE Brokers

• Regulated locally by SCA

• Faster settlement for DFM/ADX trades

• AED-based funding and support

International Brokers

• Access to global markets, ETFs, IPOs

• Often cheaper for US trades

• May require currency conversions

Your broker choice should match your goals. Local exposure, global diversification, or both.

Costs and Fees to Expect

| Fee Type | Typical UAE Range | Notes |

|---|---|---|

| Commission | 0.125% to 0.275% | Local markets |

| Market fees | 0.275% | Fixed by DFM/ADX |

| Currency conversion | 0.25% to 1% | For foreign trades |

| Withdrawal fees | AED 0 to AED 100 | Depends on broker |

| Inactivity fees | AED 0 to 50/month | Applies after inactivity |

Over time, these costs can add up. If you make 10 AED 10,000 trades a year, fees could total several hundred dirhams.

Common Mistakes UAE Investors Make

-

Overtrading – Frequent trades eat into returns

-

Ignoring fees – Even small percentages matter

-

Following hype – Invest based on fundamentals, not trends

-

Lack of diversification – Don’t overload one sector

-

Skipping research – Always check the facts before investing

Long-Term Investing vs Short-Term Trading in the UAE

When you open your first brokerage account, it can be tempting to focus on quick wins. Social media posts about people “doubling their money in a week” make short-term trading look exciting. While active trading can generate returns, it also comes with higher risk and requires constant attention.

Long-term investing means buying shares with the intention of holding them for years. In the UAE, this often means building a portfolio of strong local names like ADNOC Distribution, Emirates NBD, and Emaar, combined with international blue chips. The goal is steady growth through share price appreciation and dividends. Long-term investors typically make fewer trades, which means lower transaction costs. They rely on company fundamentals rather than short-term price swings.

Short-term trading, often called active or swing trading, involves buying and selling shares over days, weeks, or even hours. This style focuses on price patterns and market momentum rather than long-term company performance. Some traders in the UAE apply this approach to local markets during active news periods, such as IPO listings or earnings seasons.

In the UAE context, there are some factors to consider:

-

Market hours for DFM and ADX are shorter compared to global exchanges, which may limit daily trading opportunities.

-

Liquidity in certain local stocks can be lower than in large global markets, affecting how quickly you can enter and exit trades.

-

Currency stability in AED can make holding foreign stocks appealing for diversification, but that comes with exchange rate considerations.

For beginners, starting with a long-term approach often builds a stronger foundation. You can still allocate a small portion of your portfolio for short-term trades to learn and test strategies. Over time, your experience will help you decide which style suits your goals, risk tolerance, and daily schedule.

Whether you choose long-term investing, short-term trading, or a mix of both, the key is to have a plan and stick to it. Avoid chasing trends without research and always keep an eye on how each trade or investment fits into your overall financial picture.

Tips for UAE Investors

• Start with a comfortable amount

• Use limit orders for price control

• Avoid unnecessary conversions

• Choose a transparent broker

• Stay updated via DFM and ADX notice boards

FAQs

How to buy shares online in UAE

Apply for a NIN, open an account with a licensed broker, fund it, and place your trade.

Can I buy shares without a broker in UAE

No, brokers are required to access DFM, ADX, and Nasdaq Dubai.

What is the minimum amount to start

There is no official minimum, but many brokers allow trades from AED 500–1,000.

How to open an NIN in the UAE

You can apply via DFM, ADX, Nasdaq Dubai, or your broker with Emirates ID and required documents.

Final Thoughts

Buying shares online in the UAE is technically straightforward once your NIN and account are set. The real test is making informed decisions that align with your long-term goals. With good research, clear understanding of costs, and awareness of market dynamics, you can begin building a confident and diversified portfolio.

Disclaimer: Remember that investing and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

14th Aug 2025

14th Aug 2025