How to Calculate Margin in Forex

Sam Reid

Staff Writer

Sam Reid

Staff Writer

The global forex market operates at a scale unmatched by other financial systems. Every day, trillions of dollars move through trades facilitated by leverage, allowing traders to control large positions with relatively small capital. Understanding how to calculate margin in forex is essential for managing risk and executing trades with clarity.

Margin is often misunderstood by beginners. Yet it plays a central role in leveraged trading. Without a clear grasp of how it works, traders can overexpose their accounts, face margin calls, or see positions closed unexpectedly.

This guide will explain how margin works, how to calculate it using simple formulas, and how traders can avoid common pitfalls.

What Is Margin in Forex?

Margin refers to the amount of money a trader must deposit to open a leveraged position. It is not a fee, but a portion of your account balance set aside as collateral for the trade.

When trading with leverage, you don’t need to fund the full value of a position. The broker provides additional buying power. Your margin contribution enables this by acting as security.

For example, a trader using 1:100 leverage only needs to contribute 1% of the trade value. A $100,000 trade would require $1,000 in margin.

Example of trading with and without margin.

How to Calculate Margin in Forex

Calculating margin in forex trading involves a straightforward formula. This helps you determine how much of your account will be committed when opening a position.

Margin Formula

Margin = (Trade Size × Exchange Rate) ÷ Leverage

Explanation:

-

Trade Size: The number of currency units in the trade (1 lot = 100,000 units)

-

Exchange Rate: The current rate of the currency pair

-

Leverage: The ratio provided by your broker

Example 1: EUR/USD, 1 Lot, 1:100 Leverage

-

Trade Size: 100,000

-

Exchange Rate: 1.1200

-

Leverage: 1:100

Margin = (100,000 × 1.1200) ÷ 100 = $1,120

This means $1,120 is required in your account to open this trade.

Example 2: USD/JPY, Mini Lot, 1:50 Leverage

-

Trade Size: 10,000

-

Exchange Rate: 109.50

-

Leverage: 1:50

Margin = (10,000 × 109.50) ÷ 50 = 21,900 JPY

If your account is in USD, this figure is converted based on the current exchange rate.

What Is a 1:500 Margin in Forex?

A 1:500 margin refers to a leverage ratio where you can control $500 for every $1 in your account. The margin required is only 0.2% of the trade size.

Example:

-

Trade Size: 100,000

-

Exchange Rate: 1.1000

-

Leverage: 1:500

Margin = (100,000 × 1.1000) ÷ 500 = $220

With just $220 in margin, you can open a position worth $110,000. However, this also increases the speed and size of potential losses. Using high leverage requires a clear risk management plan.

How Margin Requirements Work

Margin requirements are set by your broker. They are based on leverage levels, account type, and instrument volatility. Requirements are often expressed as percentages.

Examples:

-

5% margin = 1:20 leverage

-

2% margin = 1:50 leverage

-

1% margin = 1:100 leverage

-

0.2% margin = 1:500 leverage

Each figure indicates how much of the trade you must fund. Higher leverage requires a lower margin. Many online trading brokers publish this data directly in their trading platforms.

During high volatility, brokers may increase margin requirements to reduce risk. This can happen before economic announcements or major geopolitical events.

Using a Forex Margin Calculator

A forex margin calculator helps traders estimate required margin based on real-time market data. You simply enter:

-

Account currency

-

Currency pair

-

Trade size

-

Leverage ratio

The calculator provides the exact margin needed. While this tool is helpful, traders should still understand the manual calculation to stay aware of how margin is allocated.

Free Margin and Margin Level

Free Margin

This is the portion of your account equity that is not used as margin for open positions. It represents the funds available to open new trades or absorb losses.

Example:

-

Account Balance: $5,000

-

Used Margin: $1,200

-

Free Margin: $3,800

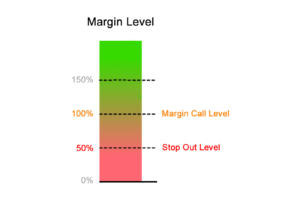

Margin Level

Margin level shows your account’s margin health. It is calculated as:

Margin Level = (Equity ÷ Used Margin) × 100

Example:

-

Equity: $10,000

-

Used Margin: $8,000

-

Margin Level = (10,000 ÷ 8,000) × 100 = 125%

A level above 100% means you have room to support open trades. If it drops below 100%, most brokers will block new positions and may trigger a margin call.

What Is a Margin Call?

A margin call occurs when your equity falls below the required threshold. This typically results from losses on open trades. The broker may:

-

Request additional funds

-

Restrict new trade orders

-

Begin closing positions to protect your account from going negative

Monitoring your account regularly can help you avoid reaching this point.

What Is a Margin Closeout?

If your margin level drops further and no funds are added, the broker will begin closing open positions. This is called a margin closeout. It is an automated process that liquidates trades to restore minimum margin.

Most platforms display a “margin closeout percentage” to indicate how close your account is to this trigger point. Staying well above this threshold gives your account more breathing room.

Tips to Avoid Margin Calls

-

Use stop losses to define maximum risk per trade

-

Keep margin usage below 50% where possible

-

Don’t trade your full account balance at once

-

Reduce exposure to correlated currency pairs

-

Watch for news events that may increase volatility

-

Close unprofitable positions before they erode equity

-

Deposit extra funds when your free margin becomes low

Managing margin properly keeps your account more resilient and avoids forced closures.

Why Margin Management Is Crucial in Volatile Markets

Forex markets are highly sensitive to global events, interest rate decisions, and economic data releases. During periods of elevated volatility, price swings can happen within seconds and without proper margin management, traders may find themselves facing unexpected losses or forced liquidations.

Brokers often respond to volatility by temporarily increasing margin requirements to reduce exposure. If you’re unaware of these changes or haven’t reviewed your open positions, a single sharp move can wipe out available margin quickly. This is why proactive margin monitoring is essential, not just for professionals but for anyone trading with leverage.

Keeping a buffer of free margin helps you stay in control during volatile periods. It also gives you the flexibility to react to market opportunities without being limited by a near-zero margin level. Successful traders treat margin as a strategic tool, not just a trading prerequisite. They check their margin usage before and after every trade, and they reduce position sizes when markets are uncertain.

Even with a strong trading strategy, poor margin management can undermine your entire approach. Understanding how much you’re risking, and how much margin each trade requires, keeps your capital protected when conditions shift rapidly.

FAQs

What is the formula for margin in forex?

Margin = (Trade Size × Exchange Rate) ÷ Leverage

This formula calculates the amount of money needed to open a position.

How do I calculate margin?

Use the margin formula or input your trade details into a margin calculator offered by your broker. Be sure to check the latest exchange rate and leverage level.

How to calculate trading margin?

Multiply your position size by the base currency exchange rate and divide the result by your leverage. This tells you how much capital will be locked as margin.

What is a 1 500 margin in forex?

It refers to trading with 1:500 leverage. For every $1 of margin, you control $500 of the asset. Only 0.2% of the trade value is needed as margin, but losses are magnified just as quickly as profits.

Conclusion

Understanding how to calculate margin in forex allows traders to manage their accounts with greater control. It ensures that trade sizes align with available capital and that exposure is kept within acceptable risk limits.

Whether you’re using a standard lot or testing smaller trades, margin is one of the first numbers you should calculate before placing any order. Taking the time to understand how it works helps prevent account imbalances and supports consistent, disciplined trading.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

06th Aug 2025

06th Aug 2025